What is a Golden Cross and a Deathcross in Trading?

Moving ahead, we will be exploring what these golden crosses and death crosses are, how they work, and how different traders can use them to make better trading decisions.

Let’s start and understand first what the Golden Cross is.

What is a Golden Cross?

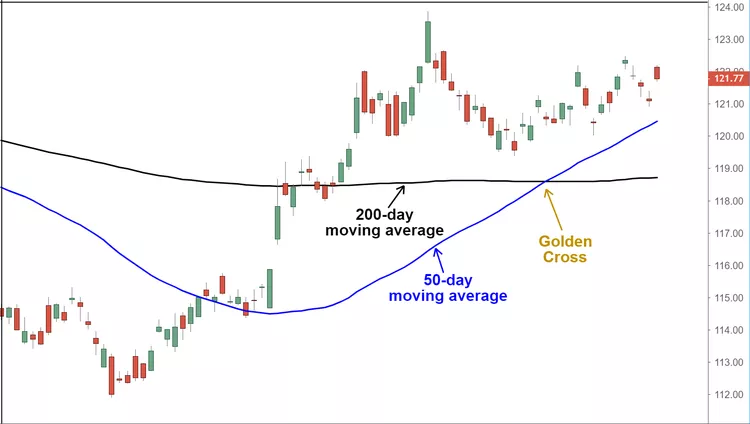

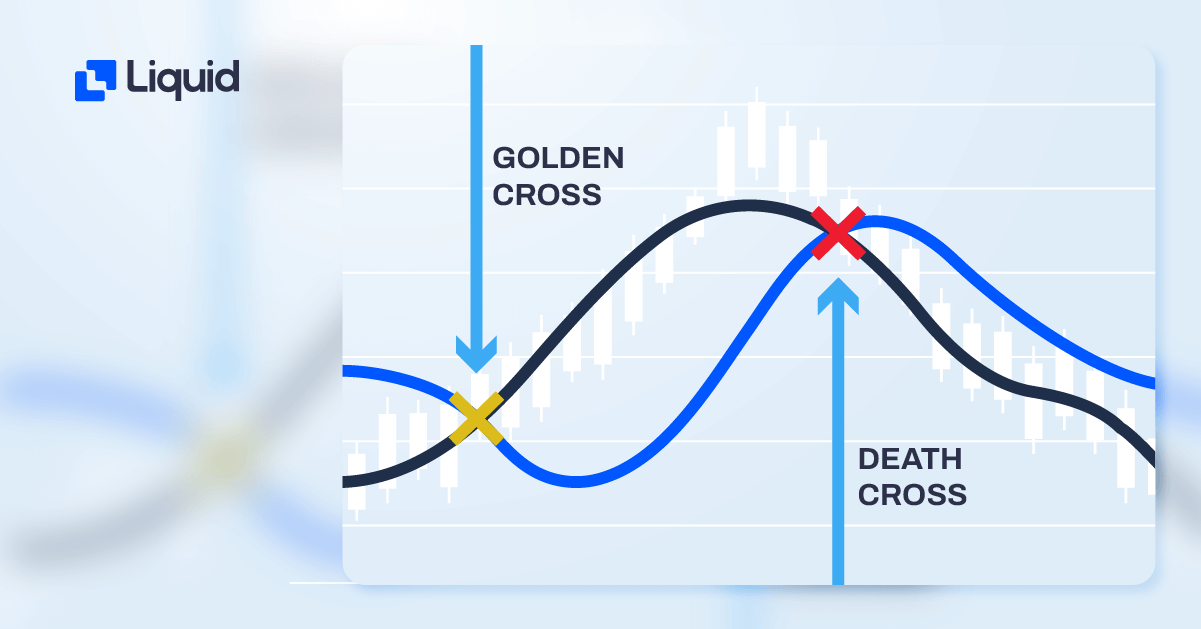

A golden cross is basically a technical indicator that occurs when a short-term moving average crosses above a long-term moving average. Let's break it down into simpler forms.

The short-term MA as mentioned above is typically the 50-day average, while the long-term is usually the 200-day MA.

When the short-term average crosses above the long-term average, it is seen as a bullish signal, which indicates that the asset is likely to trend upward, giving a peer insight to the traders planning to invest. Let's go on and learn more about how these golden cross indicators function now.

How does a Golden Cross Work?

The golden cross works by comparing two moving averages, the short-term and long-term indicators. The short-term MA is faster and more sensitive to price movements, while the long-term MA is slower and less sensitive to price movements.

When the short-term moving average gets ahead above the long-term moving average, it indicates that the asset is gaining momentum and that the trend is likely to continue upward. This is seen as a buy signal by traders, who may use it as an opportunity to enter into a long position.

The pattern generated by this cross movement of short-term average is the main signal for you as a trader to hop in and take your portion of the investment. Moving ahead we will be discussing the other essential pattern i.e. death cross.

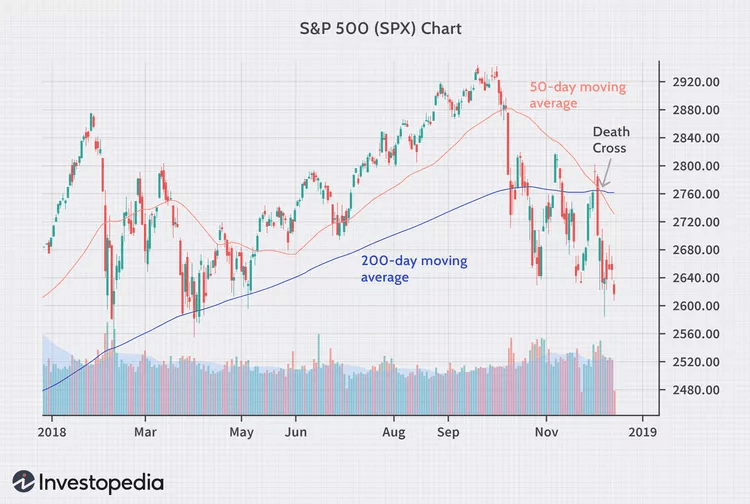

What is a Death Cross?

A death cross is the complete opposite of a golden cross. It happens when the short-term moving average drops below the long-term moving average. This is considered a bearish sign, suggesting that the asset is likely to continue its downward trend.

In the Death cross also, the short-term average is the one type with the 50-day average, while the long-term moving average is still usually the 200-day average. Let's move on and examine the operation of the death cross in more detail.

How does a Death Cross work?

The death cross works in the same way as the golden cross, but it is the one with reverse functioning. When the short-term moving average crosses below or below the long-term moving average, it indicates that the asset is losing its momentum or growth and that the trend is likely to continue downward or fall.

This is seen as a sell signal where you as a trader need to get alert and may use it as an opportunity to exit a long position or enter into a short place to safeguard your assets. Moving ahead, let's also get familiar with the term Crypto Indicator and Trading Indicator to understand where these golden crosses and death crosses are listed.

Crypto Indicators:

A cryptocurrency indicator is a tool used by traders to analyze market trends and predict future price movements. These indicators, which take into consideration past data like price and volume, are calculated using a variety of mathematical calculations and statistical models. There are various indicators which you as a trader can explore or will come through.

Moving averages, relative strength indices (RSI), and other indicators are frequently used in the crypto market. The RSI gauges the strength of the trend, while the moving average evens out price variations and spot trends. This MAs phenomenon is the one being applied at the golden cross & death cross. Now, moving ahead we will discuss Trading Indicators.

Trading Indicators:

A trading indicator is a tool used by traders to study price changes in financial markets and make better trading decisions. Trading indicators can be divided into two categories: trend indicators and momentum indicators.

Now, move ahead and let’s understand how these indicators go hand in hand with the golden cross and death cross in various fields.

Golden Cross and Death Cross in Crypto:

Golden crosses and death crosses are widely used in crypto trading. They are seen as reliable indicators of future price movements and are used by various buyers and sellers to identify potential buying and selling opportunities.

Because these signals are based purely on historical price data, hence they are suitable for being used in automated trading systems by users. Moving ahead the heading itself tells us that we will be discussing the counterparts of the golden cross & death cross in Trading.

How to use Golden Cross and Death Cross in Trading:

Golden crosses and death crosses are best used in conjunction with other technical indicators and analysis tools. You as a trader should look for confirmation from other indicators before making a trading decision based solely on a golden cross or death cross.

They should also consider the asset's overall market conditions, such as volatility and liquidity, as well as any relevant news or events that could impact the asset's price. This must have given you highlights and insights about how useful these golden crosses and death crosses are and as a trader how you can take advantage of this opportunity.

Now, let’s quickly move towards the conclusion and take our voyage of Golden Cross & Death Cross finally to the desired destination.

Conclusion:

The Golden Cross and the Death Cross have gained popularity among traders for assessing an asset's trend and spotting potential buying and selling opportunities.

When a short-term moving average crosses above a long-term moving average, it is called a "Golden Cross," while when it crosses below a long-term moving average, it is called a "Death Cross," which indicates a negative trend.

These tools can be combined with other technical indicators and analysis tools to improve trading decisions.

They are commonly found on the cryptocurrency market. Before making trading decisions, traders should also take other aspects into account.

These include the market state as a whole and pertinent news or occurrences. In general, knowing these patterns can help traders choose wise investments.

If you liked this article, check out our other article on Makers And Takers

Also, check out our article on Fan Tokens.