What is KYC in Crypto? Why Do Crypto Exchanges need it?

KYC or Know Your Customer is a process of identifying and verifying the client's identity when opening an account and periodically over time.

What does KYC stand for in Crypto Exchanges?

Before delving into the why, let's start with the what. KYC, or Know Your Customer, is a verification process that crypto exchanges employ to confirm the identities of their users.

This multifaceted procedure is instrumental in preventing illicit activities like money laundering and terrorism financing.

This involves collecting personal information such as name, address, and date of birth. Adhering to KYC standards helps exchanges avoid legal liabilities, promote safety in the cryptocurrency community, and build trust with users.

Click here to learn how to keep your Crypto safe!

More about KYC for Crypto Exchanges:

The expansion of the cryptocurrency market has attracted the attention of both international and domestic financial regulators.

In these situations, regulators put pressure on cryptocurrency companies to abide by the same laws as traditional banks.

Therefore, one of the key discussions in the adoption of KYC for cryptocurrency has been how to find the right balance between user security and privacy.

Avoiding the usage of cryptocurrencies illegally would be the main goal of KYC for cryptocurrency exchanges. The cryptocurrency market has currently experienced tremendous net expansion, with new coins having a discernible influence.

Although the bitcoin market is usually volatile, consumers have continued to join the cryptocurrency trend despite this.

Exchanges for cryptocurrencies must implement KYC regulations, much as conventional financial institutions. However, several of the KYC specifications for bitcoin exchanges have run into opposition from some exchanges.

The anonymous nature of cryptocurrency may be compromised by the collection of KYC data.

The opposition to KYC verification for cryptocurrency exchanges won't last long, though, since it will be necessary to protect user security as well as the overall blockchain and cryptocurrency industry.

Why is KYC important in Crypto Exchanges?

The importance of KYC in crypto exchanges becomes evident when considering the scale of cyberattacks and financial crimes. In 2020, cybercriminals reportedly siphoned off $350 million, and by October 2022, approximately $3 billion worth of cryptocurrency had been stolen. Hackers often exploit the anonymity provided by blockchain technology to avoid detection.

KYC procedures not only enhance the reputation of crypto exchanges within the crypto ecosystem but also lower the risk of cyberattacks. Many argue that the crypto space, due to its anonymity, has become a breeding ground for cybercrime, necessitating stricter regulation. KYC strengthens a crypto exchange's position in the blockchain and cryptocurrency landscape.

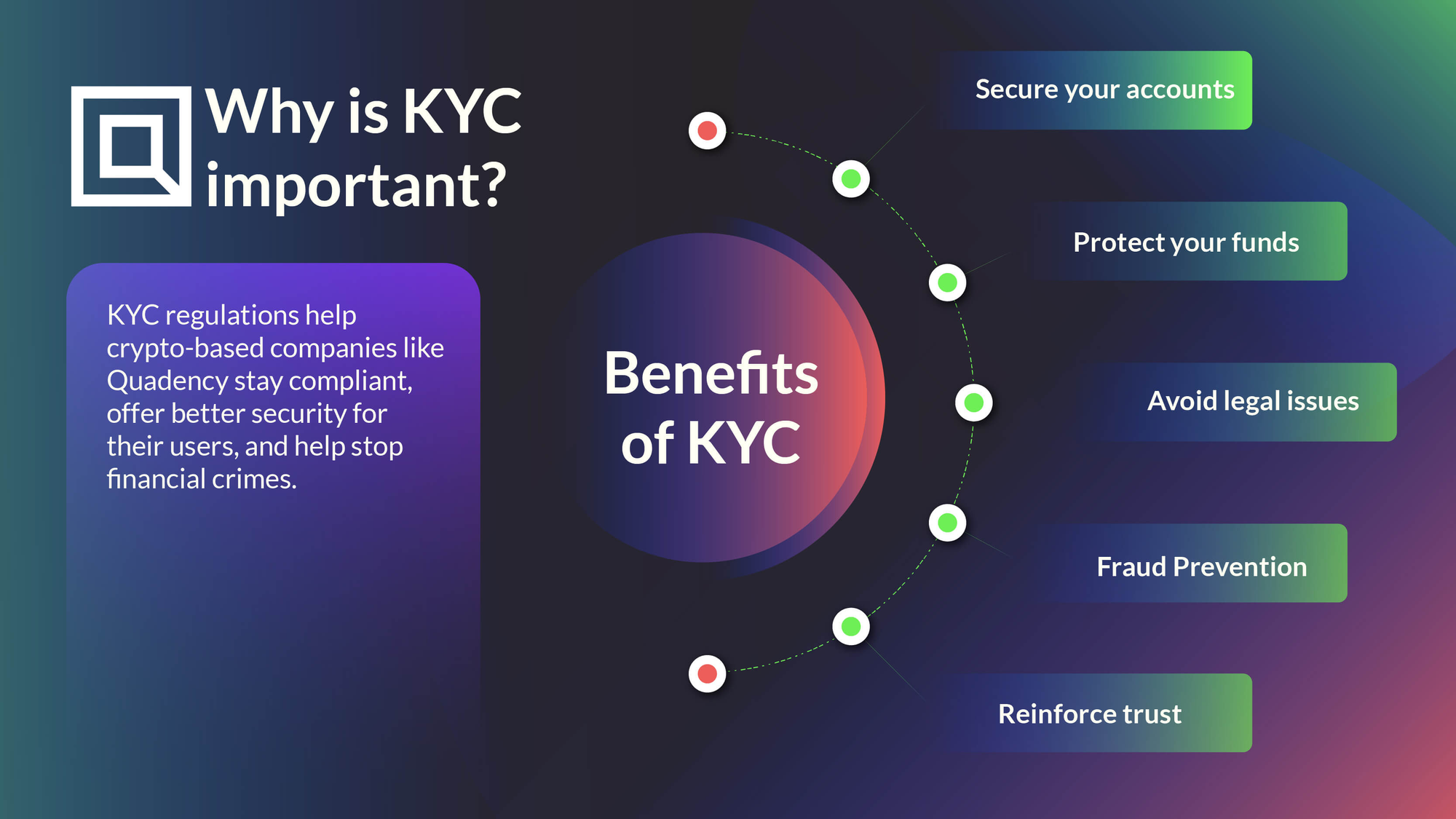

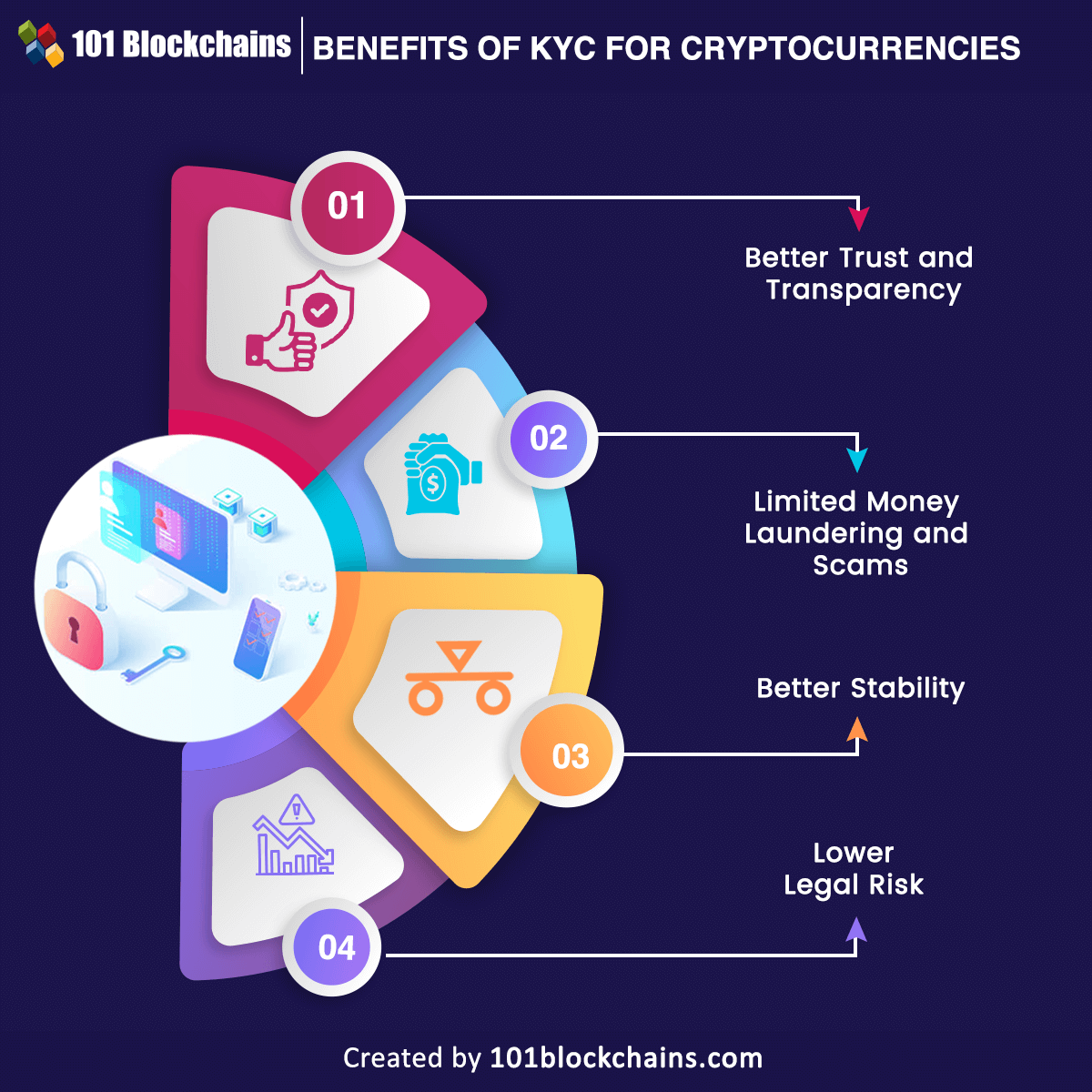

More Transparency and Trust:

Verifying user identities may lead to more transparent outcomes and raise consumer confidence in cryptocurrency exchanges. Customers can trust cryptocurrency exchanges that use KYC procedures as an extra measure to protect their investments.

The Benefits of KYC for Cryptocurrency Exchanges

The implementation of KYC regulations may introduce operational complexities and exert pressure on exchanges. However, the benefits are substantial:

Minimal Fraud and Money Laundering:

Only in the United States in 2021, Forbes found over 80,000 separate instances of cryptocurrency fraud. Strong identity verification could lessen fraud while also enhancing the market reputation of an industry that is currently setting its foundations.

Improved Stability:

Cryptocurrency market instability is a common criticism, and exchanges without KYC raise concerns about asset security during market turbulence.

Anonymous transactions could also worsen market volatility by enabling criminal activity. Implementing KYC can stabilise the market, improve identity verification, and increase value.

Minimal Legal Risk:

Implementing KYC for cryptocurrency is challenging due to evolving regulations, but can benefit companies by improving competitiveness and conversion rates. KYC also offers flexibility, speeds transactions, and ensures compliance with future legislation, minimizing the risk of legal or regulatory consequences.

Crypto Exchanges that do not require KYC

While KYC is prevalent, there are still avenues for purchasing cryptocurrency without undergoing this process. Exchanges like dYdX, PancakeSwap, and UniSwap V3 are popular choices that do not require KYC. However, users may still be asked for private details when withdrawing funds.

The debate surrounding KYC centers on its impact on the decentralized nature of cryptocurrencies. Some argue against disclosing sensitive information, particularly in repressive regimes. Others advocate for privacy in different contexts.

Click Here to Read about Sushi Swap's Vampire Attack on Uniswap

Conclusion

KYC in cryptocurrency is a vital component in maintaining the security and legitimacy of the crypto market.

While some companies may attempt to circumvent KYC regulations, they risk missing out on numerous benefits, including transparency, reduced fraud, and enhanced market stability.

The value of KYC for crypto exchanges lies in its ability to balance user privacy and security.

It fosters trust and credibility within the crypto ecosystem, safeguards users from security threats, and ensures compliance with ever-evolving regulations.

As the crypto landscape continues to evolve, achieving a harmonious equilibrium between regulatory compliance and crypto's fundamental principles remains a challenge worth addressing.