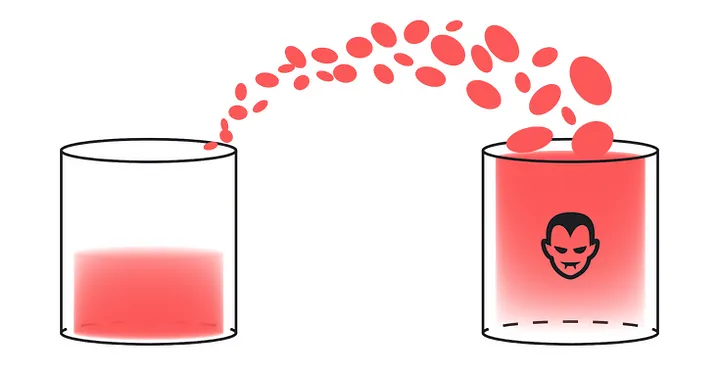

What is a Vampire Attack?

Vampire Attacks can be seen as a targeted incentive-based marketing goal to draw in more users. The project that is targeted by a vampire attack can then use the additional liquidity and trade volume from other active projects.

In order to carry out the vampire attack technique, new, alluring programmes are made available in an effort to entice consumers away from current platforms and towards the new ones.

Let’s make it simpler with an example.

Suppose, a new DEX wants to attract customers from its existing competition. What more can they offer the same customers who have already invested in their competition? Greater Incentives.

To increase incentives, they can encourage current users to transfer their LP tokens from the existing competitor platforms to the new one.

There are several ways to encourage behaviour, but the most popular one is to use the new platform's tokens to promote usage and liquidity.

By employing this tactic, the new platform can improve their own trade volume, liquidity, and use cases for its tokens.

A vampire attack uses a common protocol to get three essential things:

- Users

- Liquidity

- Trading Volume

SushiSwap, which provided better liquidity rates than UniSwap, a DEX, launched one of the most well-known vampire attack in crypto. As a result, a lot of investors moved their liquidity from UniSwap to SushiSwap.

Vampire Attack by SushiSwap on UniSwap

Uniswap is one of the biggest decentralised exchanges. SushiSwap (a Fork of Uniswap), attempted to topple Uniswap by providing higher rewards for all the liquidity providers.

SushiSwap, added "community-oriented" features including a governing token and staking rewards to the original Uniswap code within its own platform.

SushiSwap attacked Uniswap in 2020 like a vampire in an effort to attract customers and money, stealing billions of dollars worth of money from its rival and changing the Decentralised Finance (DeFi) landscape in the process.

(Click here to learn about Decentralised Finance)

The SushiSwap vampire attack started with SushiSwap producing a new token called SUSHI that closely resembled an already existing token.

The attacker then tried to persuade users to exchange their old tokens for the new token by presenting them with more alluring benefits.

Was the attack successful?

Yes.

In this instance, SushiSwap provided higher returns on investment to liquidity providers (LPs) that shifted from UNI to SUSHI. On the Ethereum Network, 1000 SUSHI tokens were given out by Uniswap to liquidity providers in the targeted liquidity pools, such as LINK-ETH and YFI-ETH.

If the attacker can persuade enough users to move to the new token, this would then result in a decrease in the cost of the UNI token, making the technique a success.

In this case, SushiSwap's vampire attack was successful since it was able to deprive Uniswap of liquidity.

Just like the SushiSwap attack on UniSwap, the crypto community saw another attack which was on one of the most famous NFT Marketplaces, OpenSea.

OpenSea Vampire Attack by LooksRare

Opensea supports a wide variety of assets, such as video games, collectables, and works of art with the number of users surpassing a million.

In an airdrop that took place in line with the platform's launch in January 2022, LooksRare gave out 2 billion $LOOKS tokens to active OpenSea users, representing 12% of the total LOOKS supply.

Users with an NFT transaction volume of at least 3 ETH on OpenSea between blocks 12,642,194 and 13,812,868 received rewards from Ethereum during a six-month period. Additionally, the first NFT transaction on LooksRare based on ERC-721 or ERC-1155 must be made in order to qualify for the airdrop.

By forcing these users to use its platform, LooksRare effectively launched a vampire attack against the OpenSea platform while simultaneously targeting active OpenSea users.

The 2% WETH fee from the users' transactions, on top of the LOOKS incentives, was another benefit that made staking hugely profitable for users. Users that stake LOOKS tokens received a portion of these transaction fees as well.

The LOOKS supply for staking was planned to be allocated to staking users at an ever-decreasing rate throughout four distinct phases, or 6500 Ethereum blocks per day, at specific maturities.

As in other projects with comparable economic models, it could be claimed that this technique attempts to safeguard the token's value by gradually limiting token emission while simultaneously recruiting a sizable user base with strong incentives when the platform is released.

Can we Prevent Vampire Attacks?

With the cryptocurrency industry growing at a very rapid pace, the chances of these attacks would only grow and this threat would continuously haunt even the big players in the market. But, some experienced investors have pointed out a few key points that you should keep in mind to safeguard your investments.

Check for Lock-In Periods

Many investors don’t know about this concept initially when they start investing. It is very important to know the lock-in period i.e. till the time you won’t be allowed to cash out your investments from a project. Find out if there is a lock-in period and how long it lasts if you are considering investing in a project. Consequently, you can safeguard your money in case the incentivization declines over time.

Implementing Hard features

A project will attract copycats if it becomes highly well-liked. These imitators will attempt to fork the project and produce their own version of it. The project should make it challenging to fork in order to guard against this. These can be accomplished by adding sophisticated features or by enlisting the support of a sizable community.

Conclusion

Vampire Attack is a relatively new player in the cryptocurrency space, but they've already generated a lot of heat in the space. Although the attacks themselves do not pose a significant threat to investors, they have been effective in driving users away from current platforms. However, if new investors play it well, these occurrences will create numerous opportunities for them to come and capture significant profits.

(Click Here to learn about Liquid Staking Derivatives)

Image Credits: Omer KEMAN; Help With Penny.