What are Exchange Flows in Crypto?

Amidst the crypto market where the number of tokens is huge and so are the exchanges, the quality of a crypto exchange becomes crucial. For any crypto exchange to be good there should be a good inflow and outflow of crypto through it. These contribute to what is known as an Exchange Flow. In this article let's dive deep into understanding about exchange flows in crypto.

How is Exchange Flow Calculated?

Exchange flow is calculated by deducting exchange outflows from exchange inflows. An exchange flow can be used to determine market participants' investment choices and to provide an insight into the market's general mood.

If the exchange flow is positive, the market may be drawing investment. On the other hand, if the exchange flow is negative a market may be losing investment.

Types of Exchange Flow:

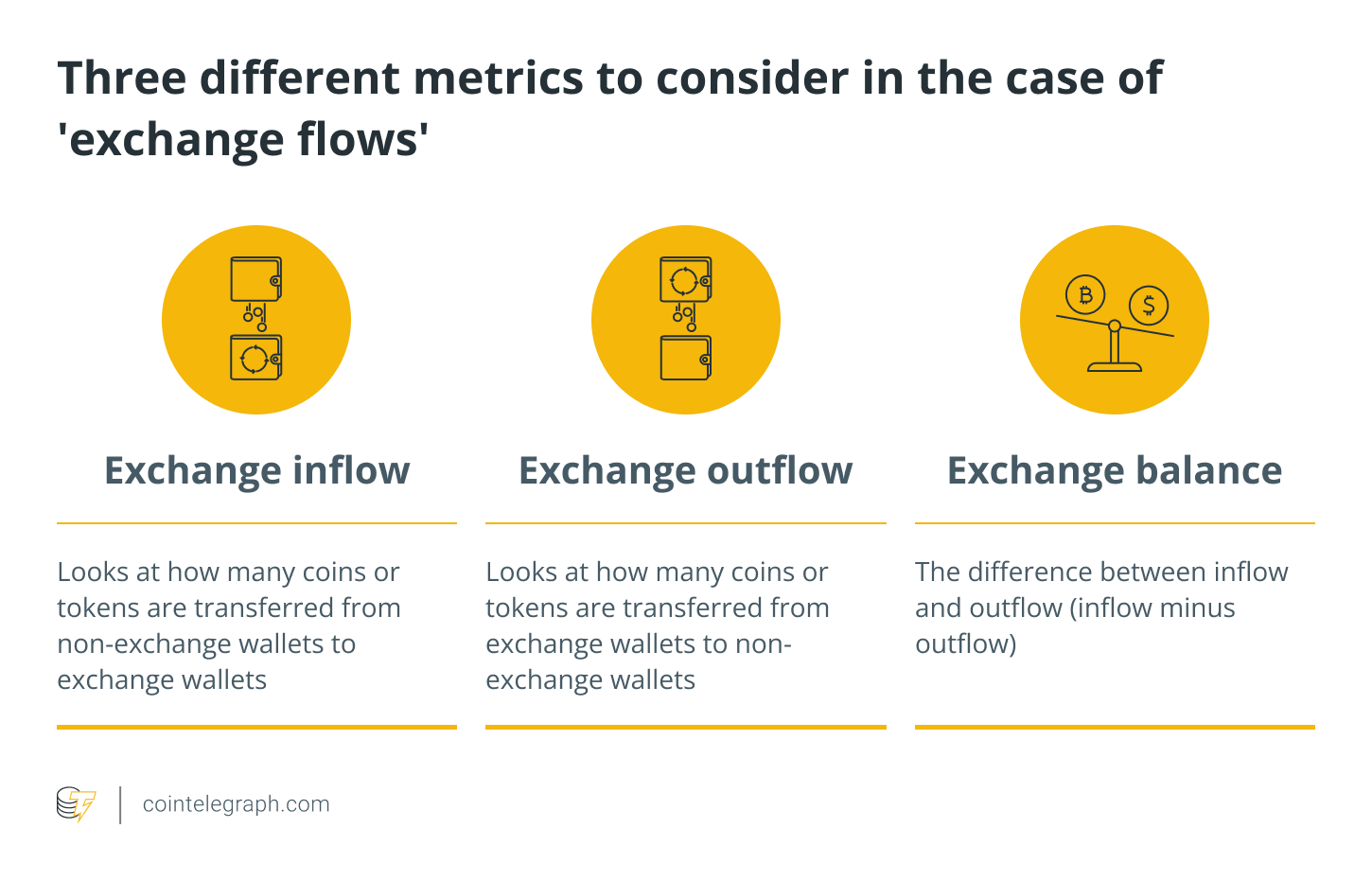

Exchange flows can be classified into 3 broad categories which are:

1. Exchange Inflow

2. Exchange Outflow

3. Net flow

What is Exchange Inflow?

Exchange Inflow is the net quantity of cash or securities entering the market. This happens if there are more sellers than buyers of a specific asset, increasing demand and driving up prices.

Sentiment wise, Exchange inflows might be considered as a sign of bullish market and may result in an increased asset price. Exchange inflow can also reveal information about participants' investment choices, such as their level of interest in particular sectors or their interest in certain geographical areas.

Exchange inflows may be influenced by a number of factors, including:

- Economic conditions: Individuals may be more inclined to invest in any financial market when the economy is flourishing and there is hope for future growth.

- Market viewpoint: If investors are upbeat about the prospects of a specific coin/token or the whole market, they might decide to invest in the market.

- Interest Rates: Low-interest rates may tempt investors to move money from fixed deposits in quest of greater returns.

Exchange inflows may also affect the general performance of an exchange. For instance, a significant inflow of capital may boost demand for assets and raise prices.

Conversely, a decline in exchange inflows could indicate a loss of trust in the market and result in a reduction of asset prices. For traders and investors, knowing exchange inflows is crucial since it can offer key insights into the market patterns allowing them to make a stronger investment choice.

What is Exchange Outflow?

Exchange outflow is the net quantity of funds leaving the market. This happens whenever there are more sellers than buyers of a specific asset, which lowers demand and reduces the price.

Exchange outflows may be a sign of a bear market resulting in price declines for assets being sold. This kind of flow can also reveal information about how market participants are choosing to allocate their capital.

Exchange outflows can be influenced by a factors, such as:

- Economic circumstances: When the economy is experiencing difficulties, investors may decide to pull their money out of the market.

- Market sentiment: If investors are not confident about a certain asset performing in the future, they might sell it off resulting in an outflow.

- Interest rates: Higher interest rates may deter stock market investment and tempt investors to withdraw money from the market.

Exchange outflows may have a damaging effect on the performance of an exchange.

What is Exchange Net flow?

Exchange net flow is the net amount of cash or securities moving in or out of the market. Exchange net flow is determined by deducting exchange outflows from exchange inflows.

Positive net flows mean that there are more inflows than outflows and that the market is drawing capital from the investors.

A negative net flow shows that there are more withdrawals than deposits and that the marketplace is losing money.

Exchange net flows give information about general sentiment of the market and can be utilized to assess investment choices. For instance, a significantly positive net flow could mean that investors are finding the market to be appealing. However, a negative net flow could mean that investors are finding the market unattractive.

Conclusion

To sum up, exchange flows are crucial in the world of finance. They describe the market's sentiment and can be utilised to assess market participants' investment choices.

Exchange rates, market mood, interest rates, and corporate performance are just a few of the variables that might affect exchange flows. From an investment point of view, traders an investors with a good understanding of exchange flows can benefit greatly but not before doing a thorough reasearch.

(Also Read: What is Fear and Greed Index?)

Image Credits: Cointelegraph