What is Crypto Fear and Greed Index? Guide For Beginners

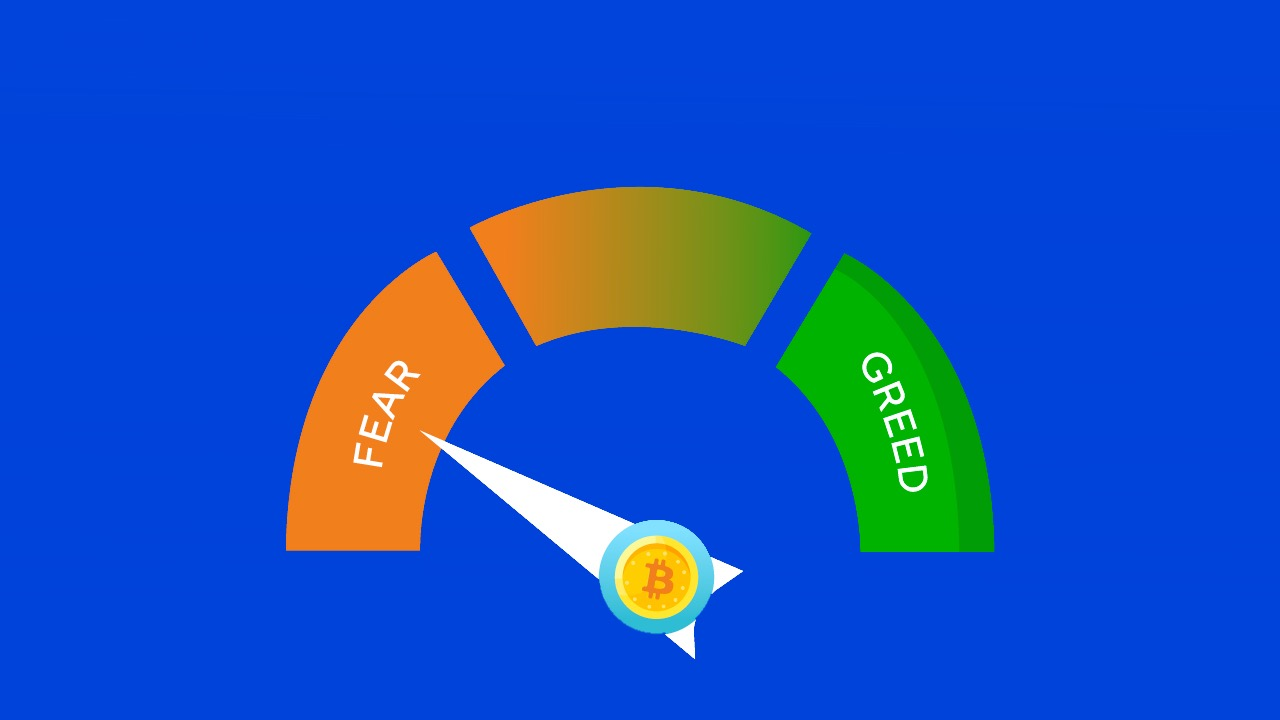

The fear and greed index in crypto is based on seven separate metrics, including market momentum, volume, social media mentions, surveys, volatility, and more. The Fear and Greed Index spans from 0 to 100, with a value of 100 denoting extremes in both fear and greed.

The Fear and Greed Index aids traders and investors in making wise selections based on general market sentiment by offering insightful information about it. In contrast, a low score on the index indicates that the market is discounted and this, maybe a good opportunity to buy, while a high score indicates a market bubble. Before we learn how to avoid fear trading and how to control greed in trading, we need to understand what is fear and greed.

What is Fear and Greed in crypto trading?

The Crypto Fear and Greed Index is a valuable tool designed to measure market sentiment within the cryptocurrency world.

It provides traders with a score on a scale of 0 to 100, with lower values indicating fear (0-49) and higher values representing greed (50-100).

This scoring system aligns with standard market psychology, where fear often leads to panic selling, while greed drives overbuying.

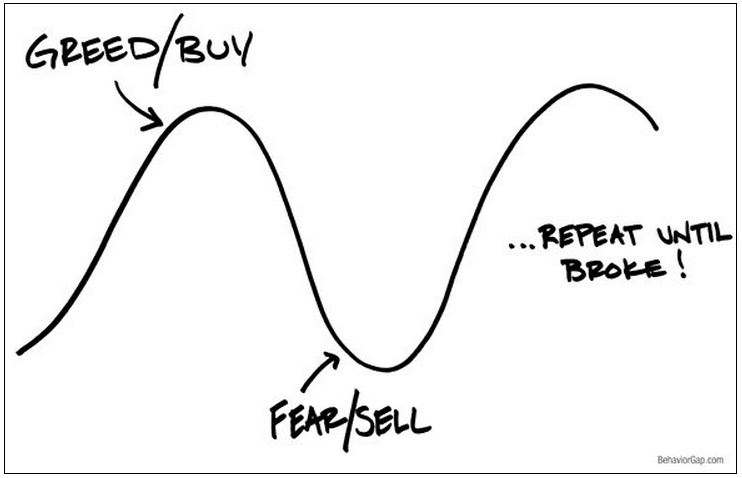

In crypto trading, decisions are significantly influenced by the emotional states of greed and fear. Greed prompts traders to seek maximum profits, while fear drives a desire to minimize potential losses.

However, acting on these emotions can result in irrational decision-making, leading to missed opportunities or substantial losses.

How to Control Fear and Greed in Trading?

Fear and Greed can make a trader incur long-lasting losses. Thus, to control these emotions in trading, the following steps need to be followed:

Implement Adequate Risk Methods

Position sizing, diversity, and avoiding orders must all be used to assess risk and keep clear of extremely greed-driven trades.

Actions To Improve

Staying connected with the market trends helps in staying well clear of poor decisions based on greed.

Implement Proper Risk Management Techniques

Use stop-loss orders, position sizing, and diversification to control risk and avoid excessive greed-driven trades.

Keep A Log

A record of trades, can help in staying clear of future errors driven by emotions viz greed and fear.

Uses of Fear and Greed Index

Investors can use the Fear and Greed Index to better understand the market mood and guide their investing choices. When the market has a high fear score, it may be a good idea to buy because the market is likely in a panic zone.

A high greed score, on the other hand, suggests that the market is overvalued and that it may be time to sell before the bubble bursts.

It is vital to remember that the Fear and Greed Index should not be the only factor considered while making financial decisions. Fundamentals, market analysis, technical analysis, and other aspects too should be taken into account.

Additionally, one can use the fear and greed index as a tool to spot market trends and future market reversals. For instance, the market may be overbought and due for a correction if the fear and greed index is now at a high level of greed.

But if the index is displaying a lot of fear, it can be a good idea to buy because the market is probably undervalued.

The Fear and Greed Index should be used as a guide rather than a reliable indicator because it is not always accurate and can change quickly.

Conclusion

The Crypto Fear and Greed Index is an indispensable resource for traders, investors, and analysts seeking to navigate the crypto market successfully.

By understanding market sentiment and managing emotions, traders can make more informed, data-driven decisions, avoiding impulsive actions based on fear or greed.

This index has become a cornerstone of the crypto market, offering valuable insights into the ever-evolving world of digital assets.

If you liked this, check out our article on Margin Trading.

Image Credits: shrimpy; awealthofcommonsense; bitsgap.