What Is DeFi (Decentralized Finance)?

Banks and financial exchanges are black boxes. We know what utility they have but have NO clue what happens in the backend.

DeFi’s goal is to create a more accessible and transparent financial system that puts control back in the hands of regular people.

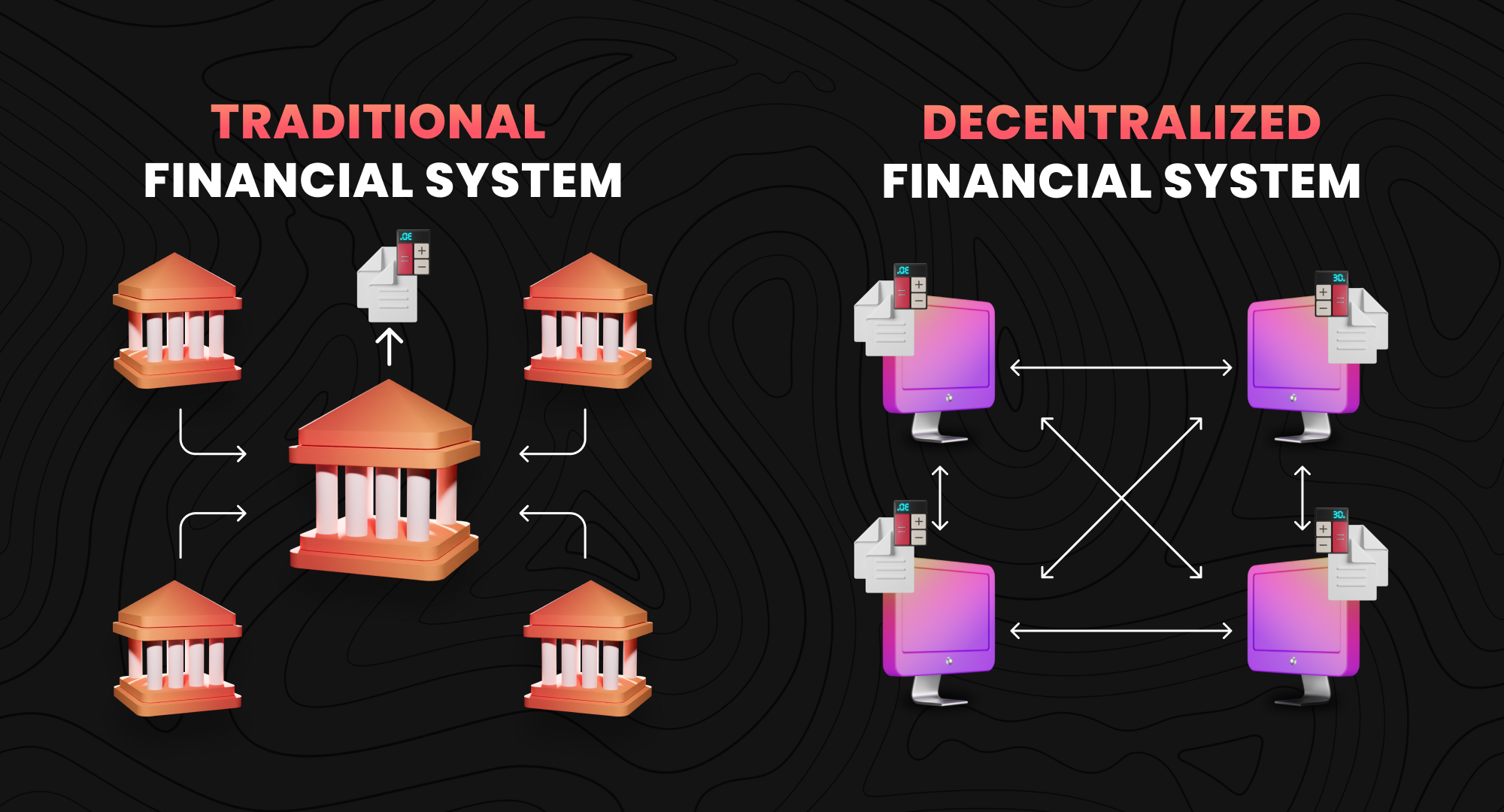

So, let’s compare DeFi (Decentralized Finance) and TradFi (Traditional Finance).

DeFi vs. TradFi

When comparing DeFi to Traditional Finance, the most prominent distinction lies in who controls the financial system.

In Traditional Finance (TradFi), central authorities such as governments and central banks exert control over the financial system. This often involves opaque financial transactions, the necessity to trust intermediaries like banks, and limited access based on business hours.

Conversely, Decentralized Finance (DeFi) operates without a central authority. It relies on code, enabling users to send money, earn interest, and obtain loans directly through smart contracts. Let's delve into a detailed comparison between the two:

Trust

- TradFi:

In Traditional Finance, intermediaries like banks hold your money, necessitating trust in these institutions. - DeFi:

With DeFi, you retain control of your money, relying on smart contracts to manage it, reducing the need for trust in intermediaries.

Transparency

- TradFi:

Traditional financial transactions are often shrouded in opacity, making it challenging for individuals to ascertain the inner workings. - DeFi:

Many DeFi protocols are open source, enhancing transparency by allowing users to examine the underlying code.

Identity and Access

- TradFi:

Accessing traditional financial services typically involves applying for a bank account with identity verification, restricted by business hours. - DeFi:

DeFi protocols are accessible 24/7, and users can transact without revealing their identity, provided they possess a cryptocurrency wallet.

Returns

- TradFi:

Traditional financial institutions, like banks, often offer minimal returns, with middlemen taking a significant portion of earnings. - DeFi:

DeFi offers the potential for higher returns due to reduced intermediaries, albeit with increased risk associated with the nascent and unregulated industry.

Risk

- TradFi:

Traditional banks are federally insured and subject to rigorous regulation, reducing some risks for customers. - DeFi:

DeFi protocols are currently not insured or heavily regulated, introducing risks such as token price volatility, smart contract vulnerabilities, and potential scam projects.

Conclusion

As you can see, while DeFi has considerable advantages, it also has disadvantages:

- Advantages include more transparency, greater access, and higher potential returns.

- Disadvantages include higher risk associated with a nascent, unregulated industry.

It’s important to understand what you’re dealing with here. As investors, you need to understand the risk-reward equation. Always think carefully about the money you’re going to put to use.

The best approach right now is to use both systems for things they’re better suited for. Use TradFi for everyday money dealings and use DeFi for sending money internationally or earning interest on your cryptocurrencies by lending them.

Next week, we’ll understand how can you make your Crypto earn interest for you.

Till then, keep learning, keep building.

Zelta out.