Dollar Cost Averaging Explained for Beginners

So, without wasting any more lines building around the corner let’s start by understanding what is dollar cost averaging bitcoin meaning and how to dollar cost average crypto.

(Before we continue, don't forget to check out Zelta.io, a platform with zero trading fees* and an extensive selection of over 200 cryptocurrencies to trade.)

What is Dollar Cost Averaging in Crypto?

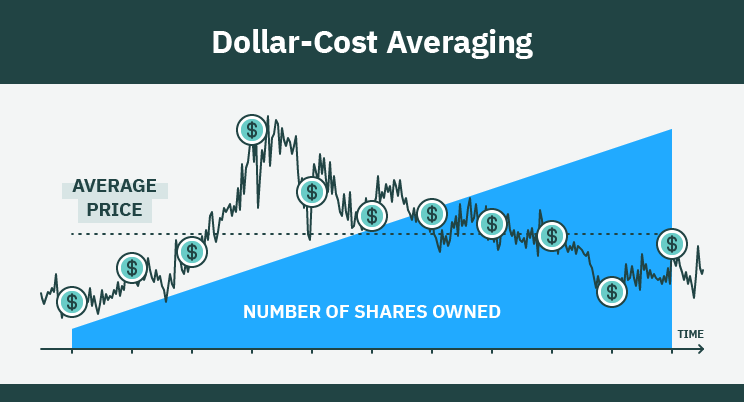

Dollar Cost Averaging is a methodical investment strategy that involves consistently investing a fixed amount of money at regular intervals, regardless of the asset's current price.

This approach is designed to eliminate the anxiety associated with attempting to predict market movements, fostering a consistent and reliable investment habit.

By automating purchases, DCA simplifies the management of volatile markets, promoting regular investments.

Regardless of the price, DCA ensures that the same sum of money is invested in the target security over a predetermined period. Investors benefit from lower average costs per share and reduced portfolio volatility when implementing DCA.

Working of Dollar Cost Averaging for Crypto:

In the world of cryptocurrency, where prices can fluctuate wildly over short periods, DCA proves to be a popular trading strategy. Investors who have consistently applied DCA, particularly to cryptocurrencies like Bitcoin (BTC), have often achieved a lower average purchase price.

The cryptocurrency market, while promising, is marked by turbulence. DCA mitigates risks and shields investors from sudden price swings. As blockchain technology and cryptocurrencies continue to evolve, DCA remains a valuable tool for reducing risk and promoting steady, long-term growth.

(Click here to learn why Bitcoin is a Good Investment)

Uses of Dollar Cost Averaging:

Dollar Cost Averaging isn't limited to cryptocurrencies; it's a versatile strategy applicable to various investment avenues. For instance, traders can utilize DCA to make regular investments in mutual or index funds, whether within a taxable brokerage account or tax-advantaged accounts like traditional IRAs.

New investors looking to venture into ETFs often find DCA to be a suitable method. Many dividend reinvestment programs also facilitate DCA by enabling consistent purchases. Moreover, DCA is a prevalent approach in 401(k) plans, designed for long-term investment. This retirement savings plan, governed by the Internal Revenue Code, allows employees to make periodic contributions from their paychecks, often matched by employers.

More about the 401(k) plan:

Many American firms provide 401(k) plans, which are retirement savings plans with favourable tax treatment for the saver. It has a section number from the United States Internal Revenue Code (IRC).

When a worker enrols in a 401(k), they consent to have a portion of each paycheck put directly into an investing account. A portion or the entire contribution may be matched by the employer. The employee has a variety of investment alternatives, most often mutual funds.

Employees who participate in 401(k) plans can pick the investments they want to make and the amount they want to contribute. After then, the investments are made on autopilot each pay period. Employees may notice a greater or lesser amount of assets transferred to their accounts depending on the markets.

Dollar Cost Averaging vs Investing as Whole:

DCA and lump-sum investing represent two contrasting approaches. DCA spreads investments over time, minimizing exposure to market risks, while lump-sum investing places the entire capital into the market at once, potentially exposing it to immediate price fluctuations. DCA offers the benefit of achieving a lower average purchase price over time, compared to lump-sum investments dependent on market conditions at the time of entry.

To illustrate the power of Dollar Cost Averaging (DCA), let's consider an example. Suppose you have $50,000 to invest in cryptocurrencies. If you make a single lump-sum investment at the current price of $50,000 for one Bitcoin, your cost basis would be $50,000. However, by dividing that $50,000 into five equal $10,000 purchases at different price points, your average cost base would be $40,000, and you would hold more Bitcoin.

Risks of Dollar Cost Averaging:

While DCA is a robust strategy, it carries its own set of risks. In scenarios where the market experiences rapid price increases, automatic crypto purchases might result in higher costs for smaller amounts of cryptocurrency.

Furthermore, multiple purchases following a significant market upswing could increase your cost basis, contrary to DCA's intent. Some investors might opt for lump-sum investments during market downturns, hoping for larger returns, although accurately timing the market remains a formidable challenge.

Conclusion:

In the world of cryptocurrencies, where the objective is to buy low and sell high, mastering the art of investment requires a well-considered strategy. DCA emerges as a potent approach that not only helps navigate market volatility but also instills the discipline necessary to achieve financial goals in the ever-evolving crypto landscape.

While there is no one-size-fits-all approach to cryptocurrency investment, DCA stands as a reliable method for those seeking long-term wealth accumulation. For those aiming to time the market perfectly or exit at the right moment, lump-sum investments might be tempting, but they come with their unique set of risks and no guarantees.

In conclusion, in the complex world of cryptocurrency, mastering the art of investment requires more than mere luck. Dollar Cost Averaging, with its steady and consistent approach, offers a path to success that aligns with the unpredictable nature of the crypto market.

If you liked our guide on “dollar cost average explained”, check out our blog on Spot Trading or our other blog on Tokenomics.

Trade Bitcoin and 200+ other coins with 0 fees* on Zelta.io.