All about Tokenomics

Tokenomics, a combination of two words: “Token” and “Economics” is the backbone of all cryptocurrencies. It determines whether or not a particular cryptocurrency will be deemed valuable.

Before the launch of a cryptocurrency, the tokenomics of the token are outlined on a paper which contains detailed information on the working of the token and how well it is backed which also includes the technology being used for running it.

In this article let's dive deeper into the world of tokenomics, how tokenomics work and the impact of tokenomics on the investors.

Tokenomics: A Deep Dive

When we say Tokenomics is the backbone of cryptocurrency it is because when a project has smart and a well-managed objective, the project is more likely to succeed than projects that are simply eyeballing the game.

To understand tokenomics via an example. Consider of any Fiat currency governed by a central bank. The printing of this fiat currency is managed by a central authority. There are also regulatory policies imposed to prevent misuse or at worst inflation.

Similarly, in case of cryptocurrencies the tokenomics govern all the regulations for that particular token. The only difference between the two is that, unlike monetary policies, tokenomics are executed through various codes uploaded over the blockchain network.

Tokenomics is responsible for structuring two things in a project-

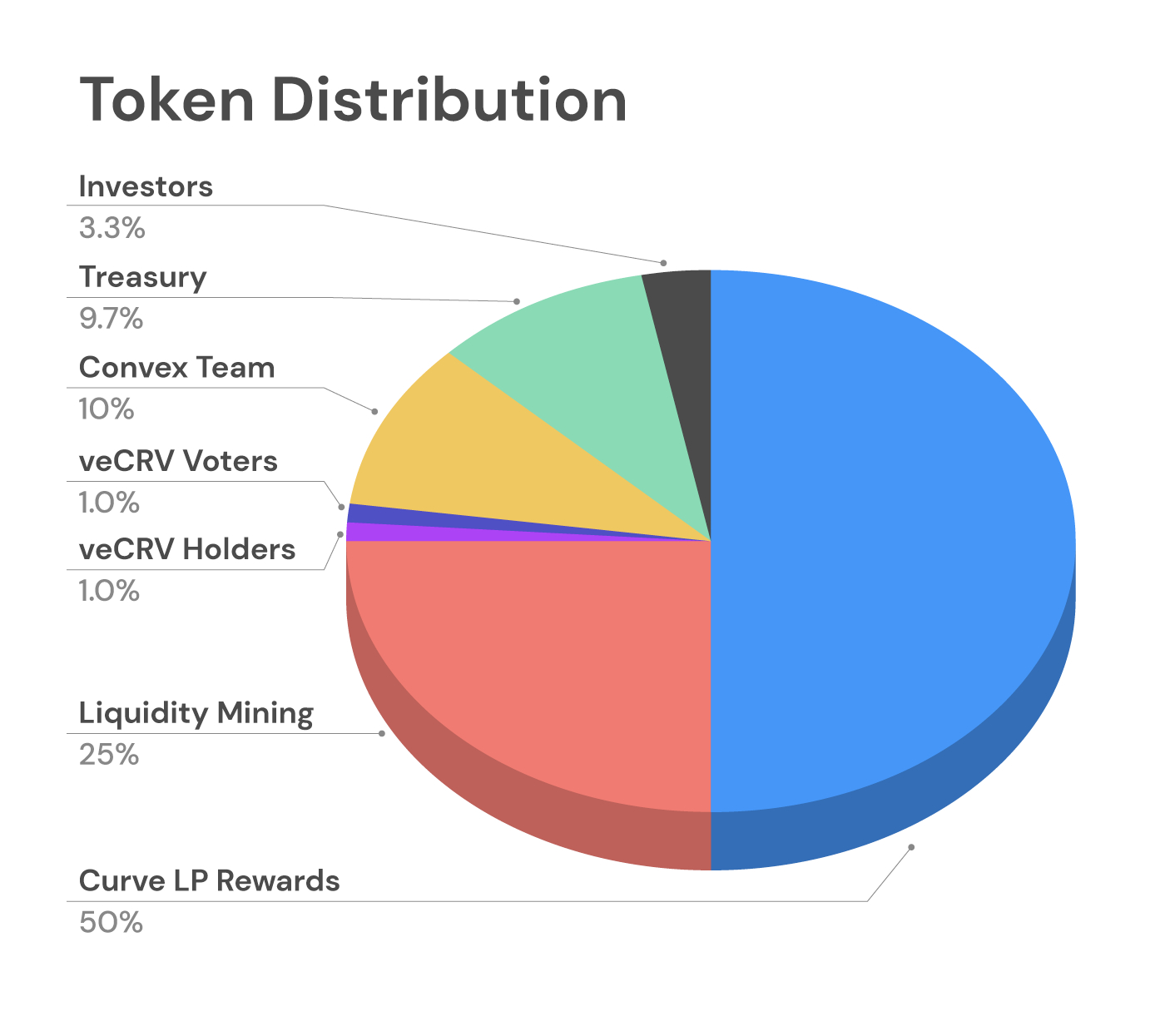

1: The method in which the token will be distributed and what amount will be available to invest.

2: The utility of a token which would leverage its demand.

Core Model Of Tokenomics

The following are the core aspects of tokenomics:

Amount of Supply: There will only be 21 Million Bitcoins. We all know this and this fact is backed by the tokenomics of Bitcoin. On the other hand, Ethereum has no supply cap, that too is backed by ETH's tokenomics. Hence the issuance of tokens relies solely on the tokenomics of the cryptocurrency.

Token Burns: Several projects do token burns for balancing supply and demand. This too is accounted for in tokenomics.

Incentive Mechanism: Tokenomics also include the consensus mechanisms which the token is expected to follow. This is usually incentivize the “The Proof of Stake” mechanism as it helps in incentivizing the users for securing the network and validating blockchain transactions.

Tokenomics for NFTs: In order to leverage the growing potential of NFTs all the developers need to set up a strong tokenomics that follows key decision-making processes. Tokenomics for NFTs is a new concept for which the developers need to keep in mind the following:

- Identifying NFT use cases.

- NFT as Collateral for getting an interest on loans.

An example of NFTs being used as a great leverage is the Bored Ape Yatch Club. The main reason for BAYC reaching the moon was the culture and narrative the Bored Ape team set up around their NFTs.

The Future of Tokenomics

Tokenomics will continue to play a crucial role in the space of Blockchain technology.

To summarize, tokenomics, is the backbone of all crypto projects as it governs the supply of tokens to the investors and also regulates the burning of tokens from time to time. In the future, tokenomics will help us explore an array of crypto tokens and make it easier in taking a call whether or not a project is headed towards the right direction.

(Click here to Learn about Dollar Cost Averaging)

Image Credits: Coinmonks; every.to; Crypto Adventure.