Crypto Spot Trading Explained

Cryptocurrencies have taken the financial world by storm, offering a secure and potentially lucrative investment avenue.

The popularity of digital assets like Bitcoin and Ethereum has made them a preferred choice for traders and investors. Among the various trading strategies available, one that stands out is spot trading.

In this comprehensive guide, we will delve into what spot trading in crypto entails, its significance, and how it functions.

The buying and selling rules for these distributed ledger systems on exchanges are outlined in a trading strategy for investors.

Various strategies are being provided or mentioned by the investors and one of the most famous ones in these strategies is Spot trading, this trading style refers to one of the fundamental ways to invest in cryptocurrencies, in which traders purchase assets to sell them at a profit in the future.

Let’s start first by understanding what is spot trading.

(But before that, be sure to give it a try on Zelta.io, a platform with zero trading fees* and an extensive selection of over 200 cryptocurrencies to trade.)

Spot trading, also known as spot transactions, allows users to buy or sell cryptocurrencies instantly.

The term "spot" signifies that these transactions occur immediately at the current market prices.

This style of trading is named so because the transactions are settled on the spot, ensuring prompt and precise delivery of currencies or commodities.

In a spot transaction, a buyer places an order with a specific bid or purchase price, while a seller sets an ask or sale price.

The bid price is the maximum a buyer is willing to pay, while the ask price is the minimum a seller will accept.

This system ensures that trading occurs within the user's available balance, preventing overextension.

The world of cryptocurrencies operates on a spot trading model. These digital assets are traded on a base market, commonly referred to as the spot market.

Here, users can easily purchase cryptocurrencies like Bitcoin and hold them for potential profit when prices rise.

The primary goal of spot trading in the crypto market is to buy low and sell high. However, due to the market's inherent volatility, success is not guaranteed.

Key Concepts in Spot Trading

Before delving deeper into how spot trading works, let's clarify three fundamental terms:

Spot Price

Spot price as the name reflects is the current price for any crypto asset. The spot price is always variable since it keeps on changing based on user requirements and usage.

Trade Date

Trade Date refers to the date on which the whole transaction was carried out, from commencing the trade to keeping a record of the transaction.

Spot Date/Settlement Date

This date is the last and final key which marks the completion of the transaction as the traded assets are transferred to the buyer’s account on this day only. Therefore it is also known as the Settlement Date.

Now, you must be wondering that isn’t the trade date & settlement date are the same. No, the reason behind having the difference between both the dates is that once you complete the transaction, processing of these transactions takes time as it includes verification as well as validation of the transactions.

Usually, there is a gap of 2-3 days between the trade date and the settlement date. Now moving forward let’s take a better dive into Spot trading working.

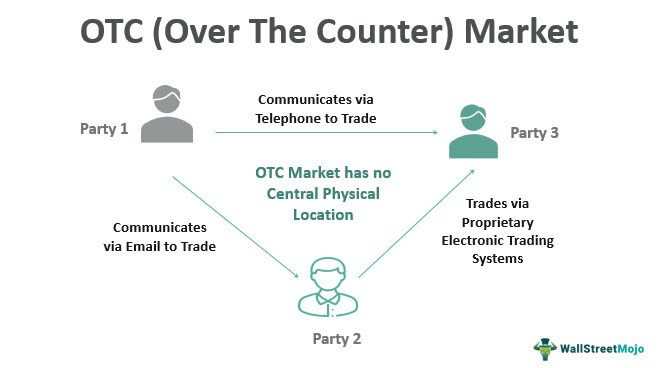

Spot trading is possible in over-the-counter (OTC) markets, decentralised exchanges (DEXs), and controlled exchanges.

Before you can trade on a centralized exchange, you'll need to deposit the cryptocurrency you want to trade.

Centralized exchanges often charge fees for listings, transactions, and other trading activities.

Furthermore, spot trading gives users the option to use their bitcoin assets for extra purposes like staking or online payments.

Pros of Spot Trading:

- Lower Risk: Spot trading carries less risk compared to margin trading, as users aren't exposed to margin calls or the possibility of losing more money than they have in their account.

- Use of Assets: Traders can use their crypto assets for staking or online payments, enhancing their utility.

Cons of Spot Trading:

Limited Returns: Spot trading lacks leverage, limiting potential profits compared to margin trading.

No Margin Amplification: Unlike margin trading, there is no potential for amplifying returns in the spot market.

To learn more about Margin/Leverage Trading, Click Here

Conclusion:

To earn from spot trade, traders typically employ a dollar-cost averaging approach and wait for the subsequent bull market. But patience is a virtue because nothing in the erratic crypto market happens instantly.

Furthermore, it is advisable to carry out the due investigation and practice risk management before dealing with any crypto assets or using spot trading tactics to prevent losses. But is cryptocurrency spot trading suitable for newcomers?

Given the highly volatile nature of the cryptocurrency market and the fact that every investor has a unique risk-return profile, it is important to consider the advantages and disadvantages of the trading technique (in this case, spot trading).

This means that traders must use prudence when choosing which assets to trade and must be knowledgeable about the market before engaging in any transactions.

Trade Bitcoin and 200+ other coins with 0 fees* on Zelta.io.