Bear and Bull Flags in Trading: A Guide for Beginners

Bear patterns and Bull patterns are often seen in charts and act as indicators for a possible market direction. In order to get the most out of market fluctuations and make smart investment decisions, traders must have a solid understanding of these patterns.

In this article we'll go over what are Bear and Bull flags and how traders may use them to their advantage.

Bear Flags and Bull Flags are chart patterns that can be seen in cryptocurrency market data. They are produced by price changes that result in a brief consolidation (or a pause) inside a more significant uptrend or downward trend.

What is a Flag pattern?

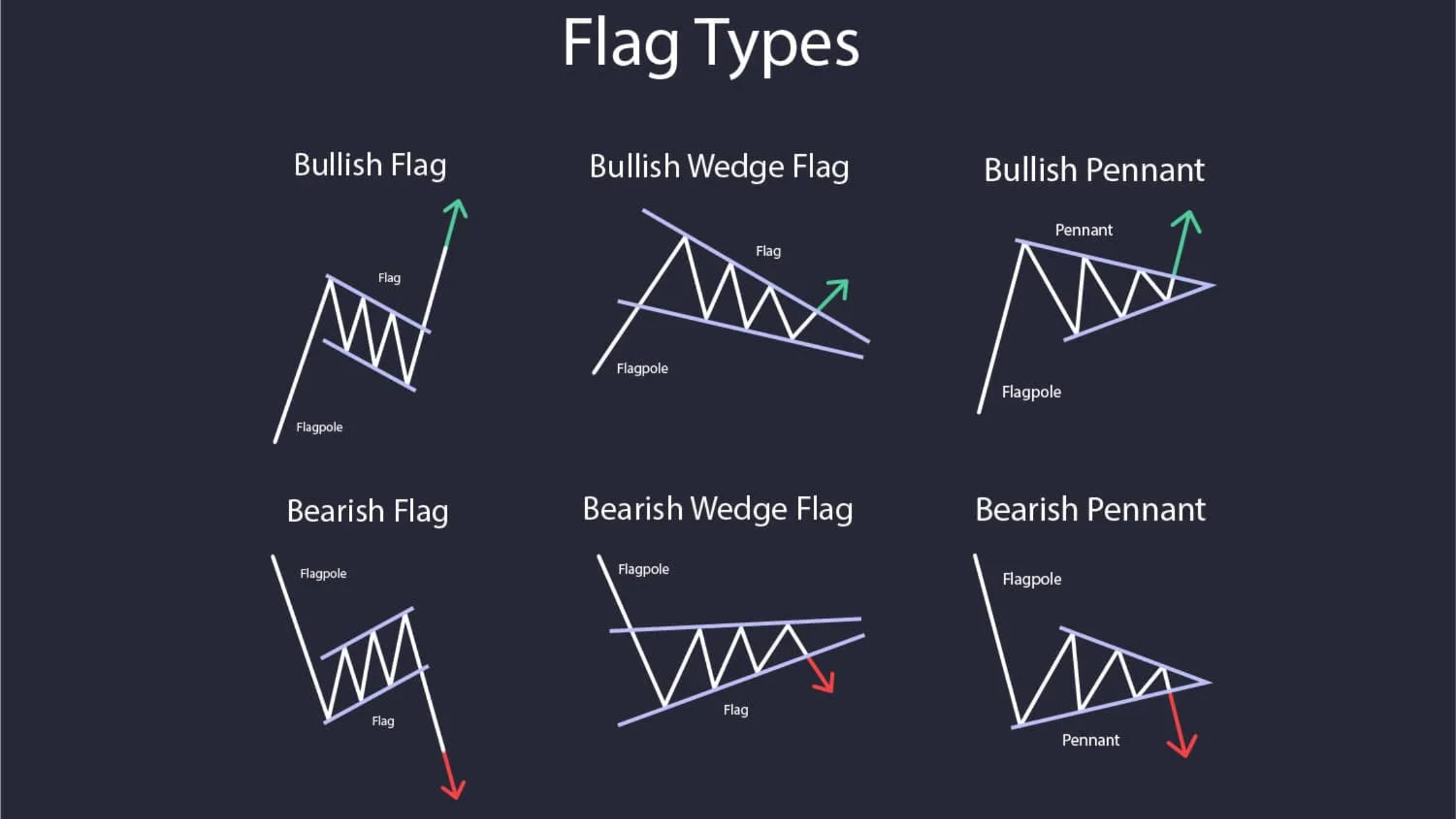

Technical analysis chart patterns called flag patterns appear when there has been a sharp price increase in either direction and the price has formed a parallelogram or a rectangle. After a brief time of consolidation or correction, the flag pattern predicts a continuation of the prior trend. The motif is called a "flag" because it resembles a flag flying from a flagpole. Depending on the trajectory of the past trend, flag formations can either be bullish or bearish.

Since the pattern suggests that the marketplace is taking a break before continuing the trend, the flag pattern is regarded as a solid indicator of a trend continuance. The height of the flagpole is used to predict the future price movement when the pattern is finished, and the pattern additionally serves to spot possible price goals. However, the flag pattern is just one technical analysis tool, and traders should utilise other indicators too for making informed trading decisions.

Benefits of Bear and Bull Flags:

Bear Flag: A bear flag is a continuation pattern that develops during a slump and suggests that prices could drop further. It is characterised by an initial decline in price, which is followed by a time of stabilization, and then another decline in price. The initial negative price movement acts as the pole in the pattern, while the consolidation period acts as the flag. In order to establish short positions, traders may watch for a collapse below the flag support line.

Bull Flag: A bull flag on the other hand is a continuation pattern that develops during an upswing and suggests that prices may increase further. It is characterised by an initial price increase, then a period of stabilization, and finally another price increase. The initial upward trading activity acts as the pole in the pattern, while the consolidation period acts as the flag. A breakout over the flag resistance line may be used by traders as a cue to start long trades.

Both the bear and bull flags can be very useful tools for traders for deciding when to buy or exit positions

How to trade with Bull and Bear Flags:

With the benefits of Bear and Bull flags known; Let us now discuss how to trade with bull and bear flags in the crypto market:

Spotting the Flag

Finding the pattern on the chart is the first stage in trading bull and bear flags. An abrupt price surge (the flagpole) is accompanied by a stabilization period that takes the appearance of a downward-sloping channel. This pattern is known as a bull flag.

In case of a bear flag exact opposite of a bull flag happends. An upward-sloping channel-shaped consolidation period followed by a severe price decline.

Find the Breakout Point

After traders have identified the flag pattern, they must find the breakout point. The price must cross above the top trendline of the flag at the bull flag's breakout point. The price's breaking point below the flag's lower trendline is known as the breakout point for a bear flag.

Establish Entry and Stop-Loss Points

Using the breakout point as a guide, traders should set their entrance and stop-loss positions. When a bull flag breaks out, traders can open a long position with a stop-loss order placed below the flag's lower trendline. For a bear flag, traders might open a short position with a stop-loss order near the breakout point.

Finalize targets

Traders should set their profit targets on the size of the flagpole when deciding on their profit targets. Traders can establish their profit objective for a bull flag by extrapolating the flagpole's length from the breakout point.

In case of a bear flag, traders can establish their profit objective by projecting the length of the flagpole from the breakthrough point downward.

Watch the Trade

In order to make sure that the price is going in their favour, traders must closely monitor the trade. Trading parties should think about closing the position to limit losses if the price moves against the trade.

Difference between Bull flag and Bear flag:

The direction of the trend is the key distinction between bull and bear flags. A bull flag is an uptrend continuation pattern that shows a brief period of stabilization before the price begins moving upward. A bear flag, on the other hand, is a continuation pattern that appears during a downtrend and denotes a brief halt before the price keeps moving lower.

The flag pattern denotes range-bound trading or a period of consolidation in both situations, during which the price fluctuates within a small range before reversing course and advancing in the direction of the trend.

In conclusion, both bull flag patterns and bear flag patterns are equally important. To decide when and how to enter or exit a trade, traders need to have a firm grasp of technical indicators.

It's crucial to keep in mind that no trading method is risk-free. But, traders can improve their odds of success and lower their risk exposure by combining these patterns with other signals and tools.

(Also read: Different Types of Orders in Trading)

Image credits: Britannica; TrendSpider