What happened to FTX? SBF Downfall Explained

In the fast-paced world of cryptocurrency, few stories have captivated the industry as intensely as the dramatic rise and fall of FTX, a once-thriving exchange, and its enigmatic owner, Sam Bankman-Fried (SBF).

This article delves into the intriguing tale behind FTX's downfall, dissecting the crucial events and revealing the far-reaching implications for the cryptocurrency market.

Who is Sam Bankman-Fried?

SBF, a brilliant MIT graduate, embarked on a journey that would lead him to become a crypto industry sensation. FTX, the exchange platform he co-founded, quickly gained a stellar reputation, earning the trust of high-ranking businessmen and everyday investors alike.

At its peak, SBF's personal wealth soared to over $16 billion, while FTX commanded a staggering valuation of $32 billion. However, a series of missteps would ultimately bring this empire crashing down.

Many people, from high-ranking businessmen to regular investors, are eager to make a difference in the world. Among these people was Sam Bankman-Fried (SBF) a famous MIT graduate who started the crypto exchange platform FTX.

SBF and FTX both gained tremendous reputation and limitless trust with billions soaring in and out. More so SBF himself was worth over 10 billion before even turning 30! But bad actions, mismanagement and misuse of funds ultimately led to the downfall of FTX and SBF both.

In this article let's uncover the full story behind the downfall of FTX.

Downfall of FTX

FTX's troubles began when Alameda Research, another venture of SBF's, started facing financial challenges. In a desperate move, SBF transferred funds from FTX to Alameda, including customer deposits and FTT tokens. This maneuver sowed panic among users who feared for the safety of their assets.

The situation worsened with the leak of Alameda's balance sheet, revealing a whopping $1 billion in liabilities. Concerned investors rushed to withdraw their funds from FTX, only to discover that withdrawals were failing. This liquidity crisis severely damaged FTX's reputation and market value.

Shorting of FTT Tokens

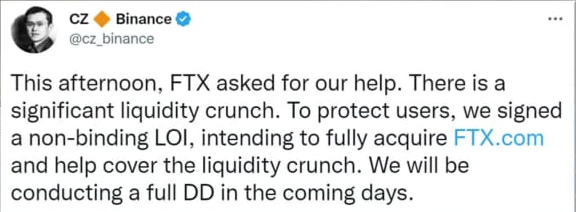

The downfall of FTX gained momentum when Changpeng Zhao (CZ), the CEO of Binance, sent a tweet that sent shockwaves through the crypto world. CZ's decision to sell Binance's FTT stockpile triggered a panic sell-off of FTT tokens, exacerbating FTX's predicament.

CoinDesk added fuel to the fire by publishing an article questioning FTX's stability.

While Alameda Research and FTX operated as separate entities, the report revealed that Alameda's assets were heavily tied to FTT cryptocurrency, raising doubts about FTX's liquidity.

As if things weren't bad enough, FTX suffered a series of cyberattacks, resulting in the loss of hundreds of millions of dollars from crypto exchange wallets. Concerns about drained wallets further rattled investors and market participants.

Despite FTX's efforts to manage the crisis, investors began to withdraw support. Sequoia Capital, a prominent investor, announced its withdrawal. The situation became more precarious when CZ, who had shown interest in acquiring FTX, abruptly backed out of the deal, pushing FTX closer to collapse.

Other measures were also being taken to manage the situation at FTX, one of the major relief signs that were available to FTX was the line of investors they were getting. One of the biggest names among those was that of Binance CEO, Changpeng Zhao.

Zhao's interest in FTX from being an investor to almost owning the company was haulted when he abruptly claimed that he was moving away from his decision to buy FTX, which ultimately caused FTX to collapse.

The official statement issued by the personnel was that they were planning on acquiring FTX so that they could provide their customer base with liquid exchanges. But, after seeing FTX’s current situation, they think it may be beyond their ability to solve & handle the current situation.

Numerous well-known investors, including SoftBank Vision Fund, Tiger Global, Sequoia Capital, and BlackRock, supported FTX. But, Sequoia announced that it was withdrawing its investment.

Then there's the story of Bankman-Fried's inner circle, a team of ten individuals who operated FTX and Alameda from the Bahamas.

According to CoinDesk, the group was a mix of his college pals and previous coworkers and was deeply entwined with Bankman-Fried's enterprise. It's highly probable that they're going through substantial losses too.

The White knight of the crypto industry whose personal net worth touched around $16 billion a few months back is now explaining how his mistakes made all that net worth disappear in a snap. Amidst this very tough year for the crypto industry, this whole affair has shaken the crypto world for the worse.

Conclusion

The rise and fall of FTX serve as a stark reminder of the cryptocurrency industry's volatility and the importance of responsible conduct. Companies and investors must exercise due diligence and prioritize transparency to prevent similar crises.

While the crypto industry faces challenges, it has the opportunity to learn from its mistakes, just as the banking industry did in 2008. Reforms and regulations can help safeguard the market, promote responsible innovation, and protect consumers.

The FTX saga is a chapter in the evolving narrative of cryptocurrency—a reminder that even the most prominent players are not immune to failure. As the industry matures, it must balance innovation with accountability to ensure a more stable and resilient future.

(Did you know a while back FTX was going to buy Celsius? Read here)

Image Credits: Market Watch; CZ Twitter.