What are Perpetual Futures Contracts in Crypto Trading?

Perpetual future contracts mirror the price movements of underlying assets, such as cryptocurrencies or commodities, on a perpetual basis. This flexibility empowers traders to adjust positions in real-time, adapting to market conditions swiftly.

Institutional investors benefit from extended holding periods, enabling long-term strategies without contract rollovers and facilitating arbitrage opportunities.

While perpetual futures bring numerous advantages, they also come with considerations and risks, such as funding rates and potential market manipulation.

In this blog, we shall cover everything, right from what are perpetual contracts to what is a perpetual swap to what is a funding rate and how are funding rates calculated.

We will also be comparing the pros and cons of perpetual future contracts as well as how they compare to spot trading and a standard futures contract.

What is a Perpetual Futures Contract?

Perpetual futures contracts in cryptocurrency are a form of derivative product that allows traders to speculate on the future price of a cryptocurrency without the need to own an underlying asset.

Unlike traditional futures contracts that have an expiry or settlement date, perpetual futures contracts do not expire, hence the term "perpetual".

Perpetual futures contracts work by mimicking the spot trading market while offering leverage, which means traders can multiply their profits (or losses) without needing to commit the full cost upfront.

Perpetual futures contracts offer greater flexibility for traders looking to speculate price movements of cryptocurrencies.

However, they also involve a higher level of risk due to the leverage involved, and thus, require a good understanding of the market.

How does a Perpetual Futures Contract work?

Perpetual futures contracts in cryptocurrency work through a system of mechanics and features that allow traders to speculate on the price of an underlying crypto asset. Let's break down the main components of how perpetual futures contracts work:

Buying and Selling

In a perpetual futures contract, you can take a "long" position or a "short" position. Unlike the traditional spot market where you buy low and sell high, in futures trading, you can also sell high and buy low.

This feature allows traders to profit from both rising and falling markets.

Leverage

Perpetual futures contracts in cryptocurrency trading often come with the advantage of leverage. Leverage allows traders to borrow funds to increase their trading position beyond what their current account balance would allow.

It is a way to multiply potential profits, but at the same time, it also multiplies the potential losses, making trades riskier.

Funding Rate

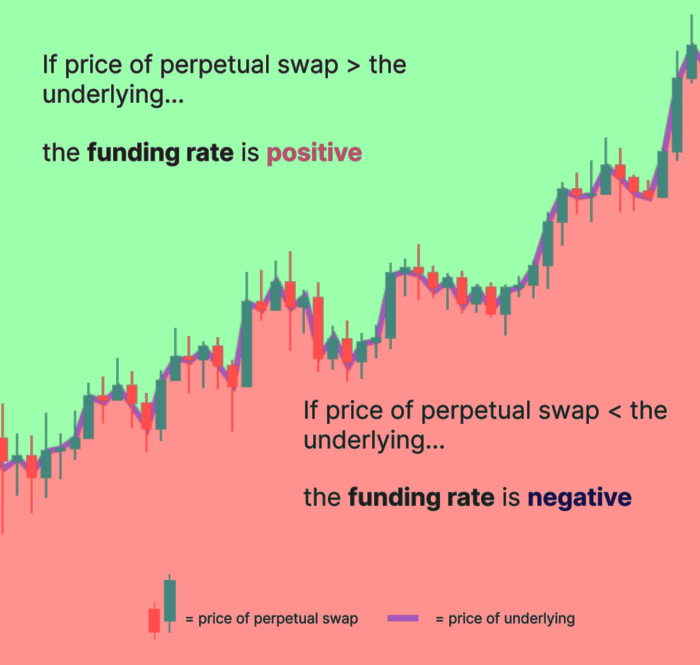

To keep the price of the perpetual contract close to the spot price, a mechanism known as the "funding rate" is used. If the price of the perpetual contract is higher than the spot price, those in long positions have to pay those in short positions.

This payment incentivizes closing long positions and opening short ones, driving the perpetual contract price down. The opposite occurs if the perpetual contract price is below the spot price.

Auto-Rollover

Unlike traditional futures contracts that have a set expiry date, perpetual futures contracts do not expire. This is because they automatically roll over at the end of each funding period, which is typically every 8 hours.

Margin and Liquidation

Depending on the platform, traders may need to post a margin. If a trader's account balance falls below the maintenance margin requirement due to adverse price movements, their position may be liquidated by the exchange.

Settlement

There's no physical settlement of the asset in a perpetual futures contract. Instead, the profits or losses are reflected in the trader's account balance, typically in the form of the traded currency.

While these contracts can be a powerful tool for speculation and hedging, it is important to note that they can also be risky due to the leverage involved and the volatility of the crypto market. Therefore, it's important to understand how they work before engaging in perpetual futures trading.

How Bitcoin Perpetual Futures Contract work?

Imagine you, a crypto trader, explore perpetual futures contracts to speculate on Bitcoin's price. These contracts have no expiry date and offer flexibility. With $1,000 in your account, leverage allows you to control a $10,000 investment.

A 1% price increase could yield a 10% gain. In the same way, a 1% decrease could result in a 10% loss.

Next comes Funding Rate.

What is Perpetual Future Funding Rate?

The funding rate in perpetual futures contracts is a mechanism used to maintain the price of the contract in line with the underlying spot price of the cryptocurrency.

It is calculated and exchanged between long and short position holders at regular intervals, usually every 8 hours.

The funding rate is determined based on the difference between the perpetual contract price and the spot price of the cryptocurrency.

If the perpetual contract price is higher than the spot price, it indicates more long positions resulting in long traders paying short traders.

Conversely, if the perpetual contract price is lower than the spot price, it indicates more short positions resulting in short traders paying long traders.

The funding rate helps in incentivizing traders to keep the perpetual contract price close to the spot price.

What happens when Funding Rate is positive?

If the funding rate is positive, it encourages traders to open more short positions.

What happens when Funding Rate is negative?

If the funding rate is negative, it encourages traders to open more long positions.

The funding rate mechanism aims to prevent the perpetual contract price from deviating significantly from the actual market price of the cryptocurrency.

How is Funding Rate calculated for Perpetual Future Contracts?

The formula to calculate the funding rate is:

Funding Rate = Clamp((Mark Price - Index Price) / Funding Interval, -0.05%, 0.05%) + Interest Rate

Where,

Mark Price: is the estimated fair market value of the perpetual contract,

Index price: is the reference spot price of the cryptocurrency,

Funding Interval: is the time period between funding rate payments,

Interest rate: is an additional fee, usually a small percentage, added to the funding rate.

Advantages of Perpetual Futures Contracts:

No Expiry Date: Perpetual contracts have no fixed expiration, providing flexibility in managing positions.

Leverage: Traders can control larger positions with less capital, amplifying potential profits.

Access to Multiple Assets: Contracts are available for various cryptocurrencies, allowing for diversification.

Profit in Bull and Bear Markets: Traders can benefit from both rising and falling markets.

Liquidity and Trading Volume: Contracts are traded on liquid exchanges with high trading volumes.

Hedging and Risk Management: Contracts can be used to hedge positions and manage risk.

Market Efficiency and Price Discovery: The perpetual futures market aids price discovery and reflects real-time sentiment.

Disadvantages of Perpetual Future Contracts:

Here are the risks involved with Perpetual Future Contracts:

Leverage-Related Risk: Leverage can amplify losses and lead to account liquidation.

Price Volatility: High volatility increases the risk of significant gains or losses.

Funding Rate Considerations: Traders need to account for funding costs, impacting profitability.

Complexity: Perpetual futures trading involves understanding various concepts and strategies.

Market Manipulation: Cryptocurrency markets can be susceptible to manipulation.

Counterparty Risk: Trading on centralized exchanges exposes traders to counterparty risks.

Limited Use for Physical Ownership: Perpetual futures contracts do not provide actual ownership of cryptocurrencies.

Now let’s compare the differences between Perpetual Futures and Standard Futures Contract.

Standard Futures vs Perpetual Futures

Let’s quickly understand the differences through the table below

| Feature | Perpetual Futures Contracts | Futures Contracts |

| Expiration Date | No expiration, contracts can be held indefinitely | Have a set expiration date |

| Liquidity | Consistently high due to no expiration | Can decrease as contracts approach expiration |

| Price Alignment | Uses a funding rate mechanism that aligns prices frequently | Prices converge with spot price at expiration (basis) |

| Trading Strategy | Suitable for both short-term and long-term trading due to no expiration | More suitable for long-term trading strategies |

| Risk & Reward | High potential reward with a corresponding high risk, subject to frequent price alignment | High potential reward with a corresponding high risk, price alignment at expiration |

| Trading Costs | Traders pay or receive the funding rate | Traders do not pay or receive a funding rate, but may incur costs due to the basis |

Now let’s move on to Perpetual Swaps.

What are Perpetual Swaps?

Perpetual swaps function similarly to perpetual futures contracts, but with a few key differences. Unlike traditional futures contracts, perpetual swaps do not have a fixed maturity or settlement date.

Instead, perpetual swaps are designed to replicate the price of the underlying asset through a funding mechanism.

In a perpetual swap, traders can take long or short positions, speculating on the price movement of the underlying asset. Long positions benefit from price increases, while short positions profit from price declines.

How do Perpetual Swaps work?

Perpetual swaps are derivative contracts that track the price of an underlying asset, such as a cryptocurrency, without an expiration date. They allow traders to speculate on the price movement of the asset using leverage.

Here's an overview of how perpetual swaps work:

Traders can take long or short positions on the perpetual swap contract.

The perpetual swap contract is designed to closely mirror the price of the underlying asset, usually through a price index or an oracle mechanism.

Leverage is often available, enabling traders to control a larger position with a smaller amount of capital, potentially amplifying profits or losses.

The perpetual swap contract's price is continuously updated and reflects the real-time price movement of the underlying asset.

A funding mechanism is employed to maintain price alignment with the spot price. Funding payments are exchanged between long and short position holders periodically, incentivizing traders to keep the contract price in line with the underlying asset's value.

Traders can enter and exit positions at any time, as perpetual swaps do not have an expiration or settlement date, providing flexibility for trading strategies and risk management.

What is Funding Rate in Perpetual Swaps?

The funding rate in perpetual swaps is a periodic fee or payment exchanged between long and short position holders.

It helps maintain price alignment with the spot price. When the perpetual swap price deviates from the spot price, the funding mechanism incentivizes traders to rebalance their positions. Long position holders pay fees to short position holders if the perpetual swap price is higher than the spot price, and vice versa.

The funding rate is calculated regularly, typically every 8 hours, and impacts the trader's account balance. Traders should consider the funding rate when holding positions for longer durations, as it affects profitability and costs.

Now that we’ve learnt what Perpetual Swaps are, let’s see the differences between perpetual swaps and perpetual futures.

Perpetual Swaps vs Futures

Perpetual swaps and perpetual futures are both derivative contracts used in cryptocurrency trading. The main differences are:

Structure:

Perpetual swaps have no expiry or settlement date, while perpetual futures have a settlement process.

Settlement:

Perpetual swaps don't require physical delivery, settling profits/losses in the quote currency. Perpetual futures involve settlement at a predetermined time.

Funding Mechanism:

Both use funding to align prices, but perpetual swaps exchange rates between long and short holders, while perpetual futures settle gains/losses between buyers and sellers.

Availability:

Perpetual swaps are found on margin trading platforms, while perpetual futures are traded on dedicated futures exchanges.

Contract Specifications:

Specifications, such as tick size and fees, can vary between perpetual swaps and futures.

Understanding these differences is essential for traders when deciding which instrument suits their needs and risk appetite.

Now, let’s compare Perpetual Futures with margin and spot trading

Perpetual Futures vs Spot Trading

Perpetual futures trading and spot trading differ in several ways:

Expiry and Settlement:

Perpetual futures contracts have no expiry date, while spot trading involves immediate settlement.

Leverage and Margin:

Perpetual futures contracts allow leverage, amplifying potential gains or losses. Spot trading typically does not involve leverage.

Price Tracking:

Perpetual futures contracts track the underlying asset's price but may deviate due to factors like funding rates. Spot trading involves buying or selling the actual asset at the current market price.

Short Positions:

Perpetual futures contracts enable short positions, allowing traders to profit from price declines. Spot trading only allows long positions.

Funding Rate and Costs:

Perpetual futures contracts involve funding rates and fees, impacting profitability. Spot trading does not have such costs.

Market Access and Liquidity:

Spot trading is widely accessible, while perpetual futures contracts may be limited to specific exchanges, potentially affecting liquidity.

Ownership and Delivery:

Spot trading offers direct ownership and delivery of the asset, while perpetual futures contracts represent derivative contracts without physical ownership.

Traders should consider factors such as flexibility, leverage, immediate settlement and funding costs when deciding between the two approaches.

What is the difference between Margin and Perpetual Futures?

Margin trading and perpetual futures differ in the following ways:

Structure:

Margin trading involves borrowing funds to leverage trading positions, while perpetual futures are derivative contracts without an expiry date.

Expiry and Rollover:

Margin trading positions have no expiry and can be held indefinitely, while perpetual futures do not have an expiration or need for rollover.

Funding and Fees:

Margin trading involves borrowing funds and paying interest, while perpetual futures use a funding rate mechanism for periodic payments between long and short positions.

Price Tracking:

Margin trading directly speculates on the asset's price, while perpetual futures aim to replicate the underlying asset's value through a funding mechanism.

Traders should assess their risk tolerance and objectives when choosing between margin trading and perpetual futures.

FAQ on Perpetual Futures

Is funding rate a good indicator?

No, funding rates alone are not considered a reliable indicator for crypto trading. While they provide insights into market sentiment and price alignment, they should be used alongside other indicators and factors for comprehensive analysis.

Traders should consider a broader range of information and conduct thorough research before making trading decisions.

Do stocks have Perpetual Futures?

No, we haven’t come across any broker that offers perpetual futures for stocks, but they do offer Futures and Options.

What is a good risk percentage in futures?

There is no set rule on what is a good risk percentage, but according to this article by CMEGroup, 2% is a good risk percentage.

Conclusion

Perpetual future contracts have revolutionized derivatives trading by eliminating fixed expiry dates and providing flexibility to investors. These contracts allow traders to speculate on asset price movements without owning the assets.

Perpetual futures offer advantages such as no expiration date, leverage for potential profits, access to multiple assets, and the ability to profit in bullish and bearish markets.

However, they also come with risks including leverage-related risks, price volatility, funding rate considerations, complexity, market manipulation, and counterparty risks.

Perpetual futures differ from spot trading and standard futures by offering continuous trading, leverage options, and short positions, but they don't provide physical ownership.

Traders must understand the workings of these contracts, associated risks, and funding mechanisms before engaging in perpetual futures trading.

Remember to always DYOR (Do Your Own Research) and focus on farming greens!

If you liked our article, Check out our other blog on Stocks vs Cryptocurrency.

Image Credits: Tasty Crypto; Aditya Palepu; crypto.news; Coffee Mug; Zebpay