How Do Orderbooks Work?

For investors and financial analysts, an order book is a very helpful tool since it offers immediate and meaningful market pricing information on the recorded securities.

The concept of orderbooks originated from the traditional market i.e. Stock market from whereon it started getting popular within the cryptocurrency market as well.

Components of Order Books

Depending on the recorded securities, an order book's structure might differ. However, it often includes a number of the items below:

Buy Orders:

All bids that contain a cost and a volume that the buyer wants to acquire are considered buy orders. The top of the purchase order book is always where the highest bid price is since buy orders on the exchange are sorted by descending prices.

Transactions are carried out at the same price until either the specified available purchasing or selling amount runs out if the highest bid price in the purchase order book is matched by the cheapest sale price in the sell order book at any given moment.

Sell Orders:

The lowest selling price is always at the head of the sell order book because sell orders on the exchange are sorted by increasing prices.

Transactions are carried out at the same price until either the indicated purchasing or selling amount runs out if the highest bid price in the purchase order book at any given time matches the lowest sale price in the sell order book.

In such a case, your request will be the first to be filled as long as it is not lower than the current lowest sale price in the Sell Orders book.

Prices:

Another key component of an Order Book is documenting the pricing. The value interests of both sides are documented in an order book. The amount that the buyer or seller is offering or requesting, together with their asking price, is shown by the number in those columns.

Visual Demonstration:

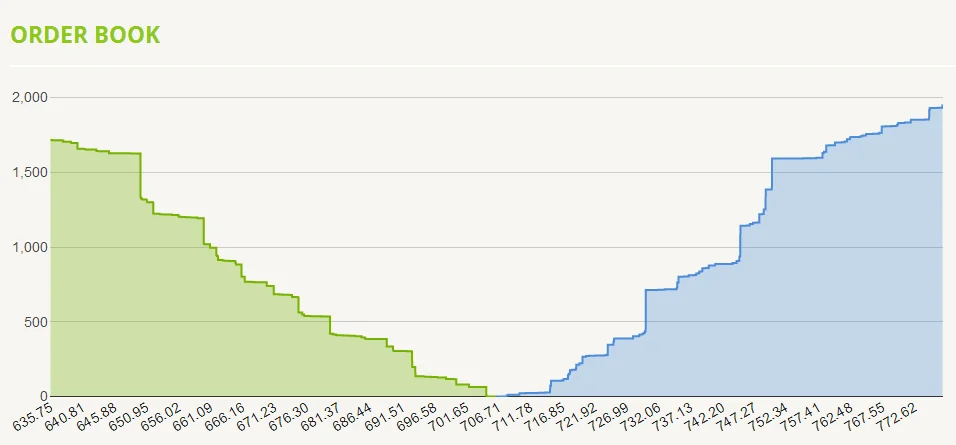

Lastly, the order books are also known for a visual demonstration of everything to the stakeholders. An order book often contains a table of figures with prices and totals for both sides.

Most order books also provide a graphic representation of the interaction between buyers and sellers in order to better describe it. It could take the shape of a line graph or another. The reader may quickly gain a general knowledge of market supply and demand in this way.

The order book also reveals any possible imbalances between the buy and sell orders that are still outstanding, which might offer hints as to the short-term direction of the price movement.

For instance, if there are much more purchase orders than sell orders, this may indicate that there is strong purchasing demand pushing the price higher.

The order book can be used by traders to locate probable levels of Support and Resistance. A significant number of purchase orders at one price may indicate a resistance level, while a significant number of sell orders at the same price may indicate a resistance level.

Uses of Order Books

Orders can be automatically matched using an order book's instant market update feature, based on the trader's preferences.

The most typical instance is when an order is filled depending on the supply and demand of the market at the time. According to the price of the present market, the order is either purchased or sold.

A trader using limit order tactics is another illustration. Traders can decide at what price point they wish to purchase and sell the securities in this situation. The order will be automatically fulfilled whenever the market price reaches the predetermined price.

Example of an Order Book

You might need to use a little bit of your imagination as we go along since an order book is a visual tool for showing information.

Consider that we are perusing Ripple's order book (XRP). Several XRP buys and sell orders are carried out every minute during the trading day. An order book aids in organizing the information so that it is simple to understand.

The XRP order book would display all of the buys and sell orders at the specified prices and timings in a chart-like format. You might be able to see any imbalances using that graphic if there are more sell orders than purchase orders. This offers some insight into how the price of XRP could change in the future as well.

Click here to learn about the SEC V/S XRP Case

Advantages of Order Books

The advantages or benefits of order books are quite obvious. They provide investors and other market players with a real-time x-ray of the market for a certain asset.

The best advantage of order books is that Real-time purchase and Sell Prices may be seen in an order book i.e. these prices are constantly being updated. It enables market players to take well-informed judgments.

Additionally, it aids market participants in comprehending long-term industry dynamics and trends if they know how to read order book crypto.

Conclusion

Order books can be termed as an instrument of choice for traders. It may be quite beneficial for traders to learn how to interpret it in order to better comprehend the market they are presently trading in or about to join.

Traders can determine the health of a security market via long-term analysis of the order book. The more market knowledge traders have, the better judgments they can take about their orders.

Orders at any price level may be deleted or updated at any moment since order books are continually changing. As a result, basing trading choices simply on the condition of the order books may not be a smart idea.