Crypto Margin Trading Explained

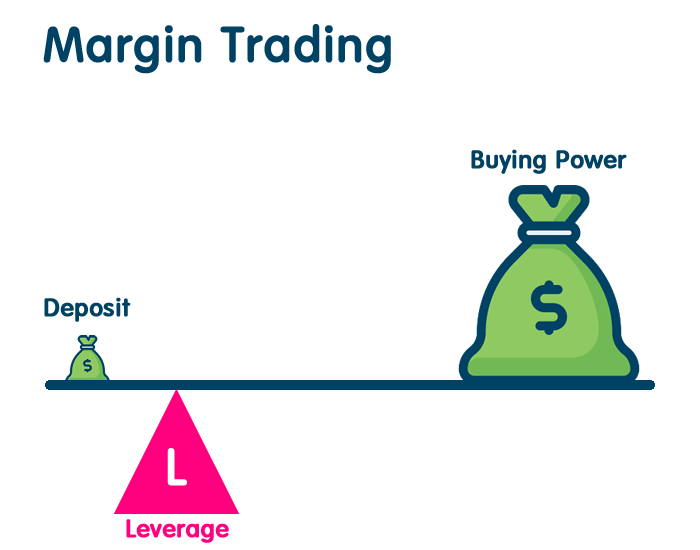

So, what is Margin Trading Crypto? Crypto Margin trading is the practice of taking out a loan from a broker to trade a greater position than you could with your own money.

Due to this, traders can boost the possible profits on their trading money by using leverage. Margin trading is often carried out in the cryptocurrency market utilising derivatives like futures or options agreements.

(Trade Bitcoin and 200+ other coins with 0 fees* on Zelta.io.)

Example of Margin Trading Crypto

An example might help you understand the concept of margin trading in a better way.

Imagine you spend $100 on bitcoin with the expectation that its price would rise 20%. In that case, you'll get $20 in profit if you pay out.

But suppose you could trade with leverage, or acquire bitcoin worth $1,000 with just $100 of your own money? If you did, you would have $200, effectively doubling your initial investment. How about if you could utilize that $100 to place a wager on the value of bitcoin falling and earn money by turning into a short seller?

(Click here to learn Why Bitcoin is a Good Investment)

In fact, you can. Margin trading is a hazardous cryptocurrency method that allows you to "leverage" borrowed money to increase earnings and decrease losses.

Margin traders prefer futures and permanent swap markets in the cryptocurrency space. Most significant cryptocurrency exchanges, including Binance, have margin trading options.

Can you Trade Crypto on Margin?

The answer to this infamous question is definitely Yes; You can trade cryptocurrency on margin. For traders who wish to leverage their trading money and potentially boost their profits, several cryptocurrency exchanges and brokers now provide margin trading alternatives.

This kind of trading enables traders to take on greater positions than they could with their own cash by borrowing money from a broker. Margin trading is not suggested for novices or those with little trading expertise, despite the fact that it may be a successful technique for seasoned traders.

Additionally, it's crucial to carry out your study and select a reputed broker or exchange that provides safe and dependable margin trading services. Understanding the advantages and disadvantages of this trading approach is crucial before using it to trade cryptocurrency on margin since it does carry a larger degree of risk than conventional trading.

You may maximise your cryptocurrency margin market knowledge and perhaps earn substantial returns by keeping these items in mind.

Benefits of Margin Trading

The ability to profit from the unpredictability of the cryptocurrency market is one of the main advantages of margin trading in cryptocurrencies. Because cryptocurrency values may fluctuate quickly and unexpectedly, margin trading can be a useful strategy for maximising returns and profiting from transient price changes.

However, it's crucial to remember that margin trading in cryptocurrencies carries more risk than conventional trading. This is due to the fact that traders borrow money to engage in trading, which effectively increases their level of risk compared to if they were using their own cash. Some of the other benefits of Margin trading in crypto include:

Short-Selling:

Margin trading enables traders to short-sell, which enables them to gain from a declining market. For traders who anticipate a short-term drop in the market, this may be advantageous.

Diversification:

By trading a variety of crypto assets, traders may diversify their portfolios through margin trading in the cryptocurrency market. This may spread the risk and maybe boost rewards.

More Trading Opportunities:

Margin trading in the cryptocurrency market gives traders access to more trading chances than they would have had they used their own money. If the trader is able to seize these chances, this might result in higher gains.

Increased Leverage:

When trading on margin, traders may trade a larger amount than they could if they were only using their own money. If the deal turns out well for the trader, this might result in increased earnings.

Cons of Margin Trading:

Before utilising this form of trading method, traders should really be aware of the drawbacks that come with margin trading. The following are a few drawbacks of margin trading:

Liquidation:

To protect themselves from future losses, the broker will immediately dissolve the trader's position when the margin account of the trader drops below a certain level. The trader may eventually lose their entire position as a result and incur additional costs.

Margin calls:

If an investor's account balance drops below a certain level, their brokers will issue a margin call, requiring them to fund their account with additional funds in order to keep their position open. The trader's stake will be liquidated if they are unable to satisfy this margin call.

High Leverage:

Using margin trading, traders may trade a greater stake than they could if they used their own funds alone. This has the potential to increase both earnings and losses, which makes it a double-edged sword.

High Risk:

Because traders borrow money to operate a larger position, margin trading is seen as a high-risk trading method. This implies that if the deal turns out poorly, they can wind up losing more money than they invested.

Conclusion:

In conclusion, cryptocurrency margin trading is a powerful tool that allows traders to leverage borrowed funds for larger positions, potentially increasing profits.

However, it comes with significant risks, including liquidation and margin calls. To succeed in margin trading, traders must employ effective risk management strategies, diversify their portfolios, and choose reputable exchanges or brokers.

By mastering the art of margin trading, individuals can navigate the crypto market with confidence, maximizing their potential returns while minimizing risks.

Trade Bitcoin and 200+ other coins with 0 fees* on Zelta.io.

To Learn about what is Shorting and Longing in Trading, Click Here