Liquidity Pool For Beginners

Among all these mechanisms one of the key factors for maintaining equality is a Liquidity Pool.

What Is A Liquidity Pool?

A “Liquidity Pool” does not mean a liquid in a pool, except it is the combination of two financial terms drawing their relevance from real-life activities. “Liquidity” is when there is a free flow of liquid cash or a token (in case of cryptocurrency) from an individual.

When a bunch of these individuals known as ‘liquidity providers’ come together, it creates a “pool”. A Liquidity Pool is a collective of money or crypto tokens provided by groups of people to facilitate trade in a dedicated group.

Unlike a traditional stock market which functions on the buyers & sellers quoting and matching their share prices for a sale aka the order book model. A Liquidity Pool carries forward a trade even if there are no sellers or buyers in the market.

Furthermore, unlike the stock market, a Liquidity Pool remains open forever.

The question here is how?

How Does A Liquidity Pool Run?

A Liquidity Pool runs on a “Smart Contract”, in case you don’t know what it means then that doesn’t matter because we don’t either (just kidding). A Smart Contract is a computer code written to allow a Liquidity Pool to exist and function.

The contract is written in a way such that it can hold funds, perform calculations (math) on those funds and then allow people to trade based on the result of the calculations.

Every Liquidity Pool contains both assets of what the individual wishes to trade for. A few examples can be BTC/USDT; ETH/BAT; BNB/USDT and several others.

Working Of A Liquidity Pool

To understand the working mechanism let’s take the BTC/USDT Liquidity Pool as an example.

Each pool contains both the assets in a 50:50 ratio i.e. Out of $100, the pool will have $50 worth of BTC and $50 worth of USDT. Now when one proceeds to buy more USDT the pool will charge the buyer slightly more for every transaction.

This is because the amount of USDT from the pool is reducing while that of BTC is increasing, thus by increasing the price the system maintains the 50:50 ratio and compensates for the decreasing amount of USDT in the pool.

The price rise however is minuscule as new tokens are being added and removed quite frequently but it also depends on the size of the pool. A smaller pool will have a larger price increase than a larger Liquidity Pool.

This is because the larger pool has so many people that the divided cost is greatly reduced.

Furthermore, the system also keeps the price in check with the current market price (CMP) or else there will simply be no buyers for a highly unreal and inflated price.

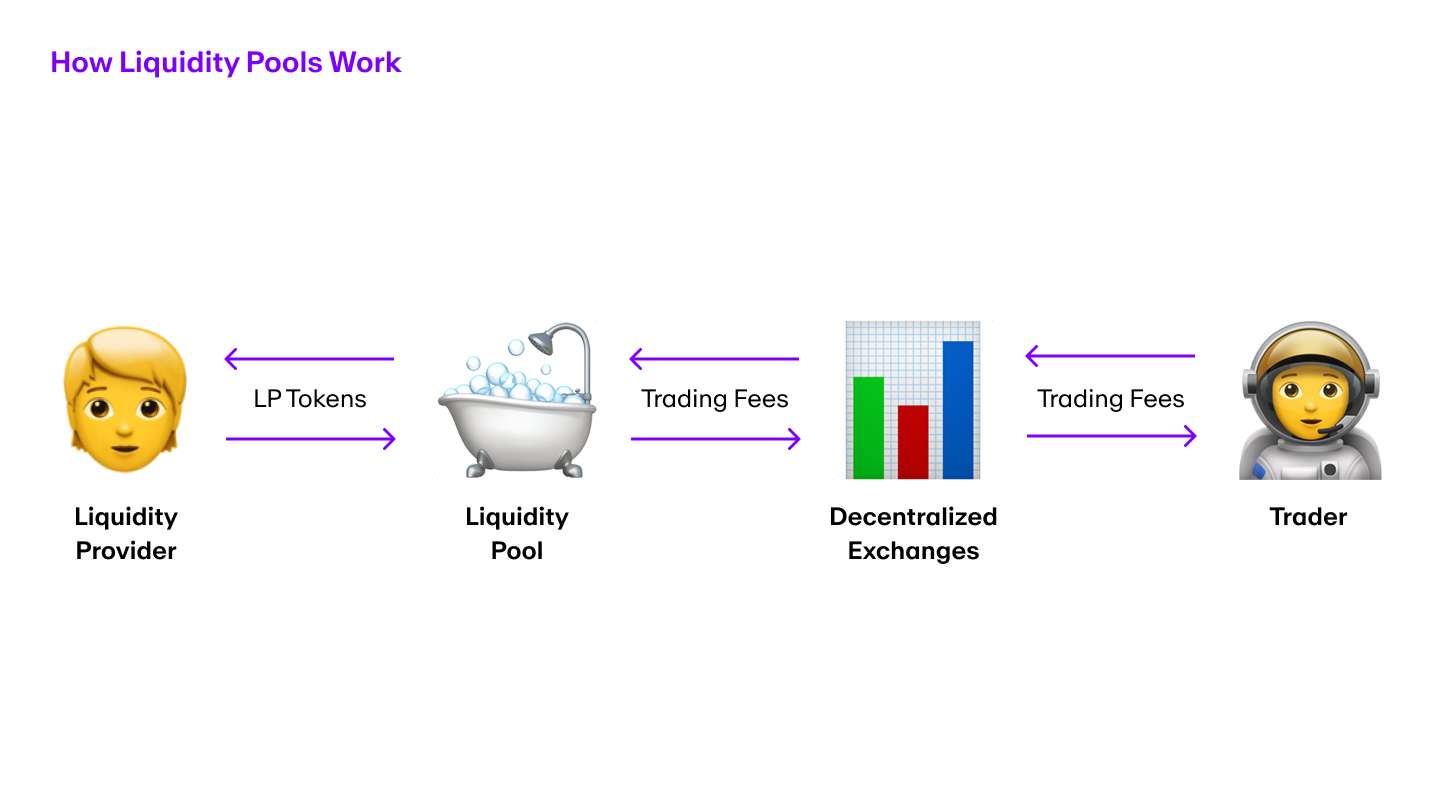

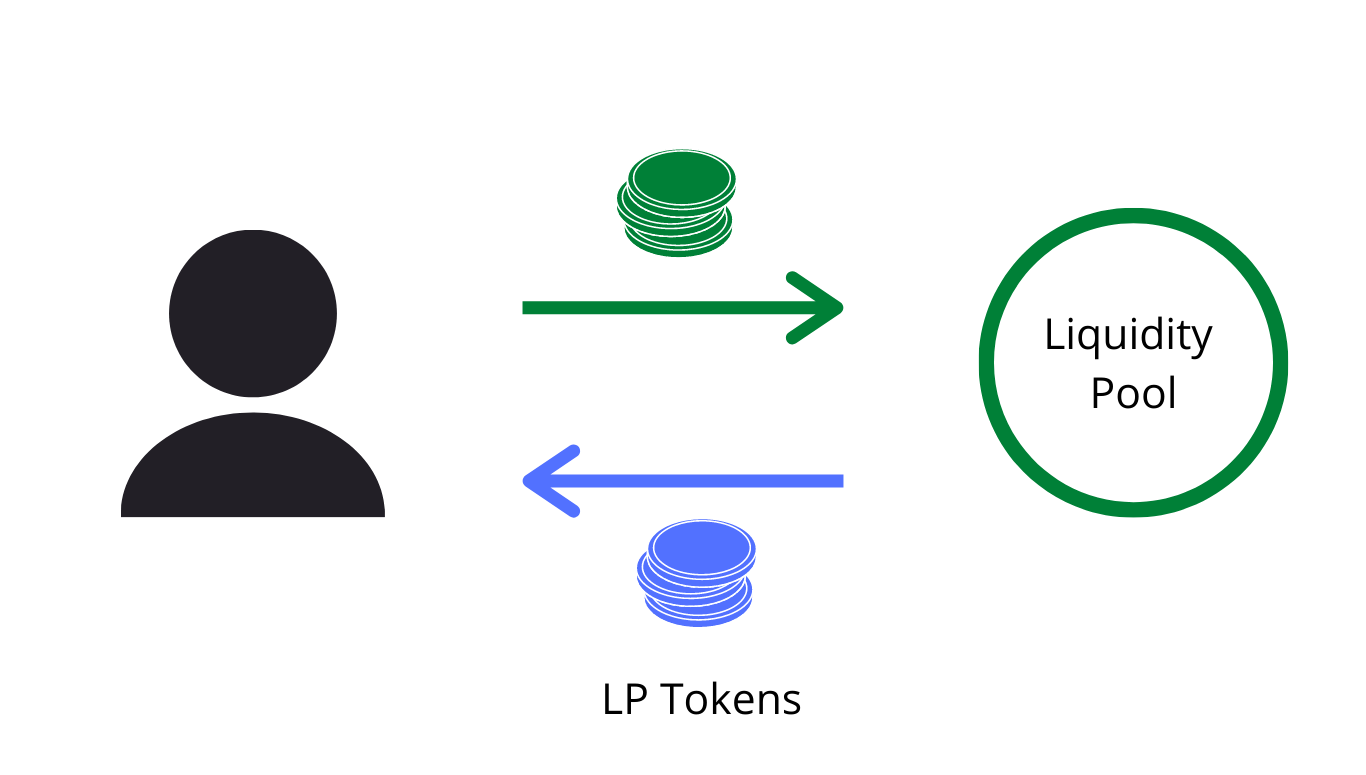

Why Do People Become A Liquidity Provider?

Now, why would one pool in their assets to become a liquidity provider? The answer to this is interesting. With every transaction that takes place in a Liquidity Pool, a certain amount of fee is levied.

This fee is very small for a single buyer/trader but as more and more people trade the fee gradually adds up to a significant amount. The system then distributes these cumulative fees to all the liquidity providers as their “cut.”

Over here the cut received by each liquidity provider depends on the size of the pool. The larger the pool, the lesser the cut as there are more providers but as mentioned earlier the larger pool will be able to maintain the 50:50 ratio without causing much of a price rise.

Some exchanges that offer Liquidity Pools are SushiSwap, Curve and Balancer on the Ethereum network.

The Liquidity Pools in these exchanges contain ERC-20 tokens. Apart from the Ethereum network, PancakeSwap, BakerySwap, and BurgerSwap function on the Binance Smart Chain (BSC) and contain BEP-20 tokens.

In addition to the cited examples, global exchanges like Uniswap and Binance contain Liquidity Pools from multiple networks.

Uses Of A Liquidity Pool:

Yield Farming:

This is a process where liquidity is used for yield generation or liquidity mining. The yield is an automated process and platforms like Yearn Finance offer these services.

Distribution of Tokens:

Liquidity mining acts as a solution for distribution (airdrop) of new crypto tokens aka pool tokens, to people who are a part of different projects in the crypto space.

The quantity of tokens distributed is determined by an algorithmic method which takes into consideration the number of tokens deposited in the pool by the holder.

These new tokens then can also be deposited back into another (or same) Liquidity Pool if the facility is available. As a result, more funds are generated for the extra provider.

Governance:

Depending on the type, size and strength of the Liquidity Pool, they can be extremely helpful in governance.

A formal governance proposal can be put forward in cases when there is a very high threshold of tokens and a vote is required for their governance.

However, as an alternative, pooling funds together can help the participants to rally behind a common cause which will be perceived as significant for the protocol.

Insurance against Smart Contracts risk(s):

In the DeFi (Decentralised Finance) sector, the implementation of insurance against Smart Contracts risk is powered by Liquidity Pools.

Conclusion:

The concept of a Liquidity Pool is unique to the crypto space but it certainly comes with its own risk, it is an investment after all. Before jumping in make sure to Do Your Own Research (DYOR) and avoid falling into a rug pull*.

(Rug pull is a scam run by several project owners where they pump up the value of the crypto asset, make it highly overpriced, draw investments from people and then run away with the money thereby dumping the price.)