Bitcoin Stock To Flow (S2F) Model

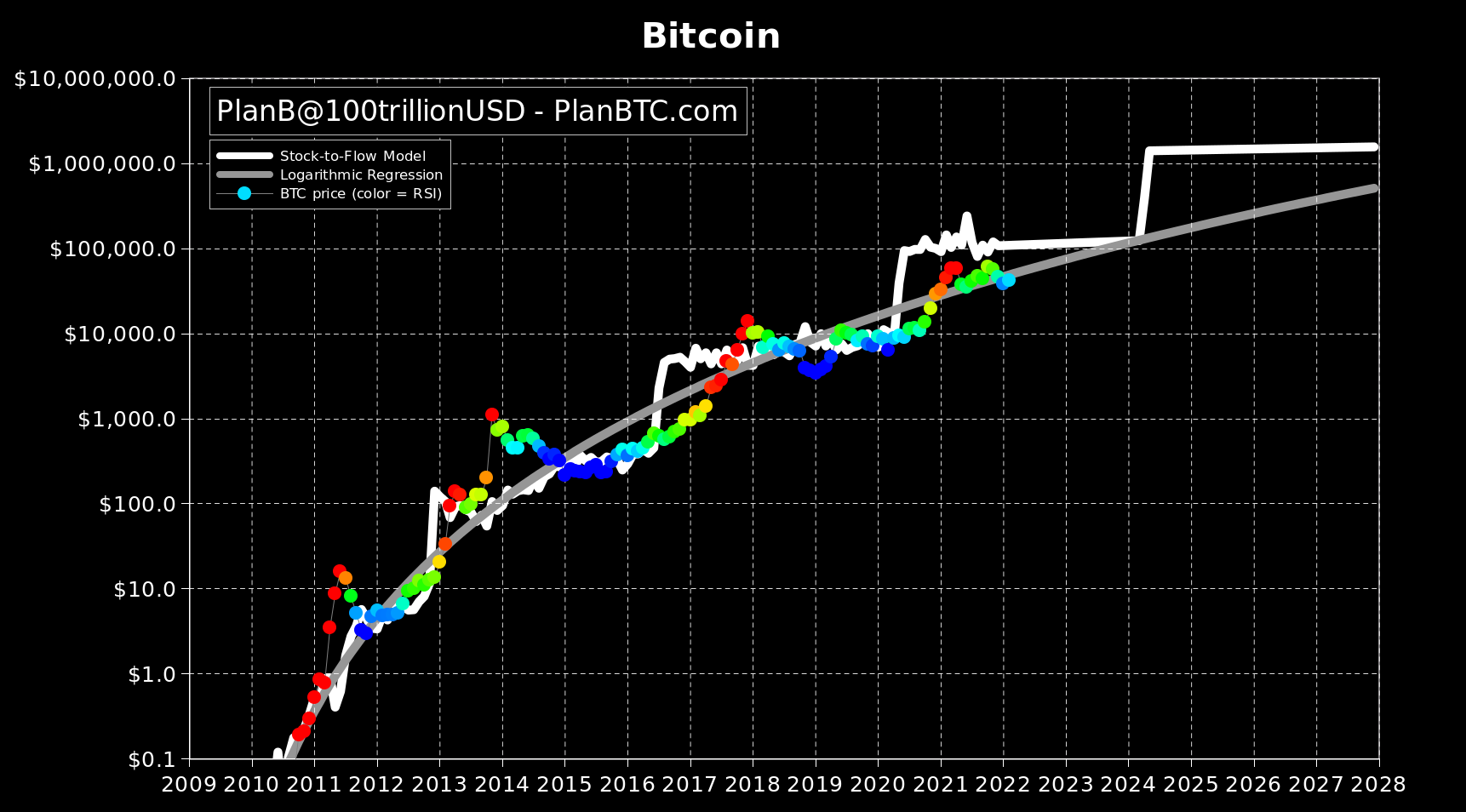

While the price of Bitcoin fluctuates every second, there is however a model that justifies the current prices and predicts the ones for the future. Say hello to the Bitcoin Stock to Flow (S2F) Model by Plan B.

Who is Plan B?

Plan B is a Dutch investor who brings a wealth of knowledge in legal and quantitative finance to the table. He is famous for creating the Bitcoin Stock-to-Flow (S2F) model which is used as a price predictor for digital crypto asset.

Plan B’s Bitcoin Stock to Flow (S2F) Model

While many of us hunt for good price prediction websites for our crypto assets, the Bitcoin Stock to Flow (S2F) model in itself is a complete package. The model so far has been fairly accurate without much drifting from the chart of Bitcoin. The Stock to Flow model plans to predict the Bitcoin prices via the Stock to Flow ratio.

In simple terms, it calculates the price by taking the current amount of Bitcoin in the existing stockpile and dividing it by its yearly production. The model, therefore, quantifies the relationship between the scarcity of Bitcoins and the price of the crypto asset.

Furthermore, the Stock to Flow ratio is directly proportional to the price of a Bitcoin. This means that the higher the S2F ratio, the higher the money flowing which in turn makes getting a Bitcoin increasingly harder.

S2F with an Example:

It is known that there are a total of 21 million Bitcoins in existence, no more and no less.

At the time of writing a total of 19 million Bitcoins have been mined successfully which means the stock value equals 19 million. Furthermore, the daily mining yield is around 900 Bitcoins, this gives us an annual flow value of 330,000.

Therefore,

Stock to Flow ratio = Stock/flow

which in this case would be:

19 million/330,000.

Approximate ratio = 57.57, which ranks Bitcoin just below gold.

Interestingly, the Stock to Flow ratio emerged during the bear market when Bitcoin was trading between $3000 to $4000, a tenth of today’s price. Since then the model has been a prediction meter or a crystal ball for the rising Bitcoin value.

Accuracy of Stock to Flow Model

In all obviousness the s2f model is not a hundred percent perfect accurate, this is because of the high volatility of the entire crypto market.

But in the past 2 years the price of Bitcoin has oscillated around the price predicted by the model. The last summer when Bitcoin left its April high of $50k the model value widened to historic levels!

Plan B as an individual is also very active in tracking Bitcoin based on its price and on-chain data but they are different from the Stock to Flow model.

As per his personal analysis Plan B predicted the worst-case scenario after Bitcoin’s plummet in June was August at a price of $47k per Bitcoin, September at $43k, October at 63k and both November & December at $98k and $135k per Bitcoin respectively.

As predicted in his tweets all the marks have been hit, with a closing at $61k in October being close to the minimum predicted target.

These prices lie way off from the Stock to Flow model which says that the price of one Bitcoin should already be around $100k.

The Stock to Flow model is not a new concept and apart from Bitcoin it has been applied to other commodities like gold and silver too. In gold, however, the supplies cannot easily be expanded because the entire process of mining gold is extremely expensive and also time-consuming.

These two reasons alone justify why gold has a high Stock to Flow ratio. Instead of depending on a single commodity, Plan B rather quantified the Bitcoin Stock to Flow model to gold, silver, diamonds and even real estate.

Types of Stock to Flow models

Plan B has released two Stock to Flow models:

- Stock to Flow or S2F

- Stock to Flow Cross asset or S2Fx

While much has been said about the first model let’s have a brief look at S2Fx.

Stock to Flow Cross asset (S2Fx)

The S2Fx model consolidates facts from Plan B’s research to provide new ideas about Bitcoin transition from proof of concept to widely adopted monetary asset.

Amazingly both the models have predicted different values, the former (S2F) models predict a value of $100k per BTC while the latter (S2Fx) has predicted a value of $288k per BTC and by the next halving a price of whopping $1million per BTC!

By design Bitcoin is scarce in nature and its creator Satoshi Nakamoto programmed it in such a way that it will always have a limited supply and it will become increasingly harder to extract new Bitcoins from the network.

As per the halving records, the block rewards were

- 50 Bitcoins in 2009

- 25 Bitcoins in 2012

- 12.5 Bitcoins in 2016 and currently,

- 6.25 Bitcoins in 2020.

These block rewards will continue to decrease and we will be seeing the next halving in 2024. The entire process of halving has an enormous impact on s2f. The flow number goes up, as a result of which the price goes up too.

At the time of writing the prediction made is for a 40% increase in value which will make Bitcoin inch closer to 100k. New ETFs also send positive signals from US bank regulators and inflation indicating a parabolic price explosion upwards.

Only time will tell what these predictions hold in store for us. Whether we will see a bull run or bear run, who knows? But Bitcoin investment in general comes with a lot of risk.

It is therefore important to always Do Your Own Research (DYOR) before finally taking an investment call.

(Click Here to Learn How to Create a Dynamic NFT)